Nifty Mar F: 11295 [ 11326 / 11120 ]

HVNs – 11165-175 / (11230) / 11290 / (11340) / 11580 / 11631 / 11734 / 11850 / 11945

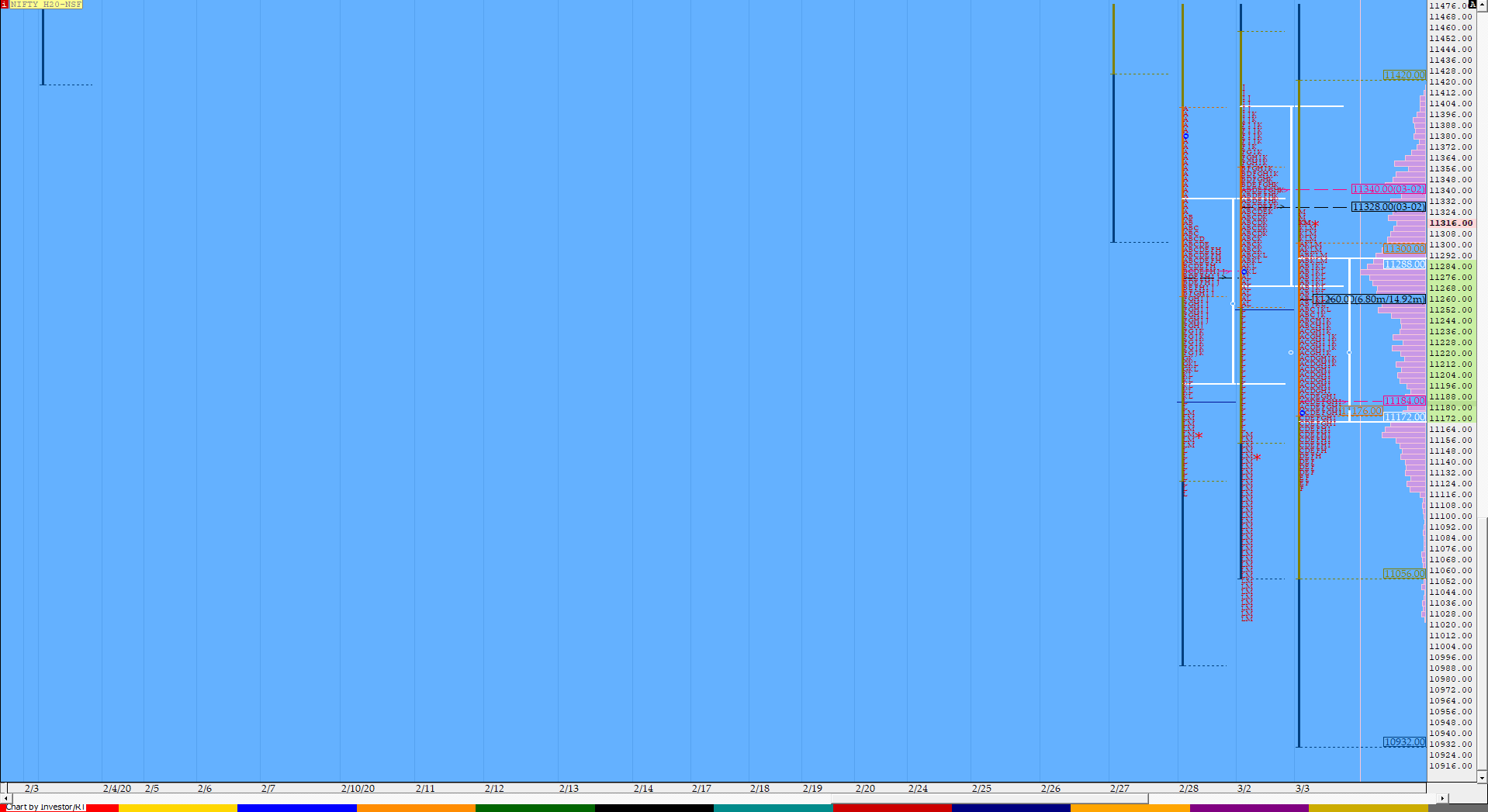

NF yet again failed to give a follow up post a Neutral Extreme Day as it opened higher in the selling tail of the yesterday’s spike of 11160 to 11258 with an almost OL start at 11180 and probed higher scaling above the previous day’s extension handle of 11258 as it made a high of 11300 in the IB (Initial Balance) as it left a buying tail from 11241 to 11178. However, the auction was not able to sustain above the HVN of 11290 and this led to a downside probe as it not only got into the morning singles but made multiple REs (Range Extension) lower for the next 3 periods as it made lows of 11120 in the ‘F’ period stalling just before the 1.5 IB objective of 11117. NF then got back into the IB ending the OTF (One Time Frame) move lower since open as it began to form a balanced profile filling up the low volume spike zone till the ‘I’ period after which it made a fresh probe to the upside resulting in a RE in the ‘K’ period after which it went on to make new highs of 11326 into the close giving a second Neutral Extreme profile in 2 days. Today’s range was completely inside the range of last 2 days and the 3-day composite has given a balanced profile with Value at 11196-11280-11365 which can be seen here.

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Extreme – Up (NeuX)

- Largest volume was traded at 11260 F

- Vwap of the session was at 11219 with volumes of 225.2 L and range of 207 points as it made a High-Low of 11326-11120

- The settlement day Roll Over point (Mar) is 11610

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11175-11260-11295

Main Hypos for the next session:

a) NF needs to stay above 11290 for a rise to 11321-340* / 11358-370 & 11396-404 & 11424

b) Sustaining below 11280, the auction could fall to 11260 / 11230-220 / 11199 & 11175-165

Extended Hypos:

c) Above 11424, NF can probe higher to 11442-465 / 11484-503 & 11535

d) Below 11165, the auction can move lower to 11136-124 / 11100-090 & 11055

BankNifty Mar F: 29224 [ 29328 / 28752 ]

HVNs – (28970) / 29100 / 29220-270 / 29425-455 / 29550 / 30085 / 30260 / 30385 / 30560 / 30640

BNF also opened higher but stayed all day in the last 45 minute range of previous day (which was from 29344 to 28600) from where it had spiked lower making a high of 29328 and a low of 28752 and in the process forming a nice balanced profile for the day with lower Value right in the Neutral Extreme reference.

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down (NV)

- Largest volume was traded at 29142 F

- Vwap of the session was at 29039 with volumes of 52.2 L and range of 576 points as it made a High-Low of 29328-28752 (if we ignore the freak tick of 29648 in the opening minute)

- The settlement day Roll Over point (Mar) is 30520

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 28831-29142-29171

Main Hypos for the next session:

a) BNF needs to scale above 28270-285 & sustain for rise to 29340-365 / 29425-435 / 29500 & 29552-596

b) The auction has immediate support at 29190-180 below which it could fall to 29130 / 29085-020 / 28922 & 28885-858

Extended Hypos:

c) Above 29596, BNF can probe higher to 29632-680 / 29700 & 29815-890

d) Below 28858, lower levels of 28800-780 / 28696-648 & 28600-580 could be tagged

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout