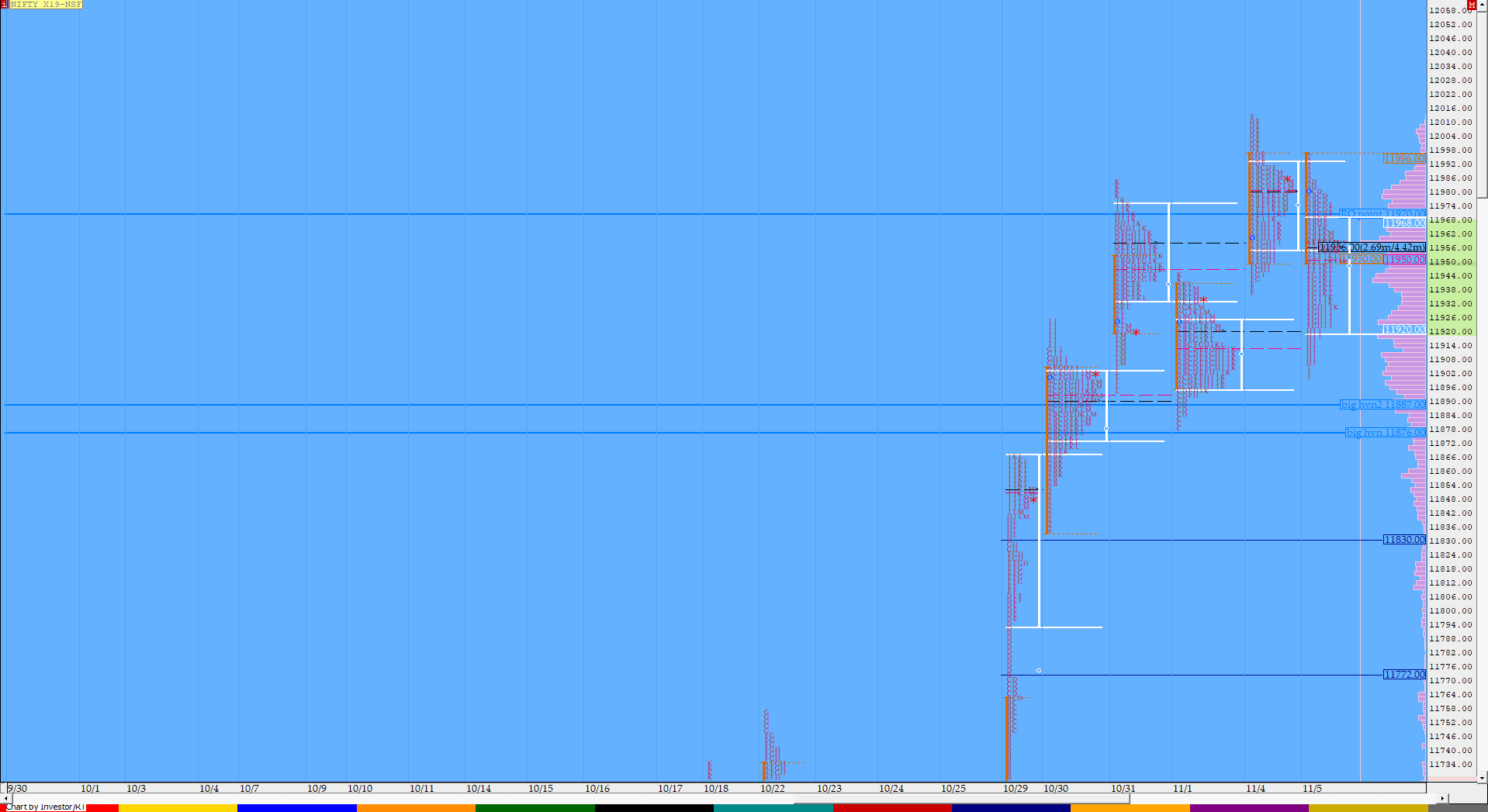

Nifty Nov F: 11956 [ 11997/ 11901 ]

HVNs – 11667 / 11814 / 11860 / 11905 / 11958

NF opened higher but got rejected at previous day’s VAH as it made a high of 11997 in the opening minutes after which it made completed the 80% Rule in previous day’s Value in the A period itself and made a similar IB range of 46 points while making a low of 11951. The auction then stayed inside the ‘A’ period making a slow probe higher as it tagged 11985 in the ‘D’ period which was also the previous week’s high and got promptly rejected from here after which it made a OTF (One Time Frame) move lower till the ‘I’ period completing the 2 IB range extension down while making a low of 11901 (which was also the weekly POC) which held. NF then got back to VWAP & the dPOC of 11957 towards close to give a balanced profile for the day. This balanced daily profile is also a part of the 4-day Gaussian profile in NF which looks like is getting completed & expect an imbalance to start in the coming session(s).

(Click here to view the 4-day Gaussian profile in NF)

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down

- Largest volume was traded at 11957 F

- Vwap of the session was at 11949 with volumes of 74.4 L and range of 96 points as it made a High-Low of 11997-11901

- NF confirmed a multi-day FA at 11895 on 04/11 and just fell short of the 1 ATR target of 12023.

- NF confirmed a FA at 12013 on 04/11 and the 1 ATR move down comes to 11896.

- NF confirmed a multi-day FA at 11465 on 16/10 and completed the 2 ATR move up of 11776. This FA has not been tagged since & hence is now positional support

- NF confirmed a FA at 11503 on 17/10 and completed the 2 ATR move up of 11808. This FA has not been tagged since & hence is now positional support

- NF confirmed a FA at 11162 on 09/10 and completed the 2 ATR move up of 11554. This FA has not been tagged since & hence is now positional support

- The Trend Day VWAP of 29/10 at 11810 will be important reference on the downside.

- The settlement day Roll Over point (Nov) is 11970

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11918-11957-11967

Hypos / Estimates for the next session:

a) NF needs to sustain above 11958-964 for a move higher to 11985 / 12003-10 & 12030

b) Staying below 11958, NF can test 11936-922 / 11901-895 & 11874

c) Above 12030, NF can probe higher to 12056 / 12079-82 & 12098-105

d) Below 11874, auction becomes weak for 11850 / 11832-829 & 11810-795

e) If 12105 is taken out, the auction go up to to 12133 / 12151-166 & 12181-194

f) Break of 11795 can trigger a move lower to 11771-767 / 11749 & 11716-709

BankNifty Nov F: 30294 [ 30520 / 30155]

HVNs – 30075 / 30150 / 30288 / 30410

(Click here to view the 4-day composite in BNF)

Report to be updated…

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Day

- Largest volume was traded at 30290 F

- Vwap of the session was at 30344 with volumes of 34.1 L and range of 365 points as it made a High-Low of 30520-30155

- BNF confirmed yet another FA at 30520 on 05/11 and the 1 ATR move down comes to 29997.

- BNF confirmed a FA at 30658 on 04/11 and the 1 ATR move down comes to 30097.

- BNF confirmed a FA at 27900 on 09/10 and completed the 2 ATR move up of 29779. This FA has not been tagged since & hence is now positional support

- The Trend Day VWAP of 29/10 at 29945 will be important reference on the downside. This was tagged on 30/10 and broken but was swiftly rejected so proves to be support.

- The higher Trend Day VWAP of 08/07 at 30995 remains important reference going forward

- The settlement day Roll Over point (Nov) is 30150

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

- The VWAP & POC of August Series 27858 & 27960 respectively

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 30178-30290-30386

Hypos / Estimates for the next session:

a) BNF has immediate supply at 30365 above which it could rise to 30410-455 / 30495-520 & 30575

b) Staying below 30280, the auction gets weak for a test of 30227-185 / 30099-72 & 30024-29997

c) Above 30575, BNF can probe higher to 30625-650 / 30725-750 & 30800-895

d) Below 29997, lower levels of 29945 / 29880-855 & 29749-695 could come into play

e) If 30895 is taken out, BNF can give a fresh move up to 30995-31005 / 31100-152 & 31210

f) Break of 29695 could trigger a move down 29635-628 / 29570-537 & 29460-435

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout