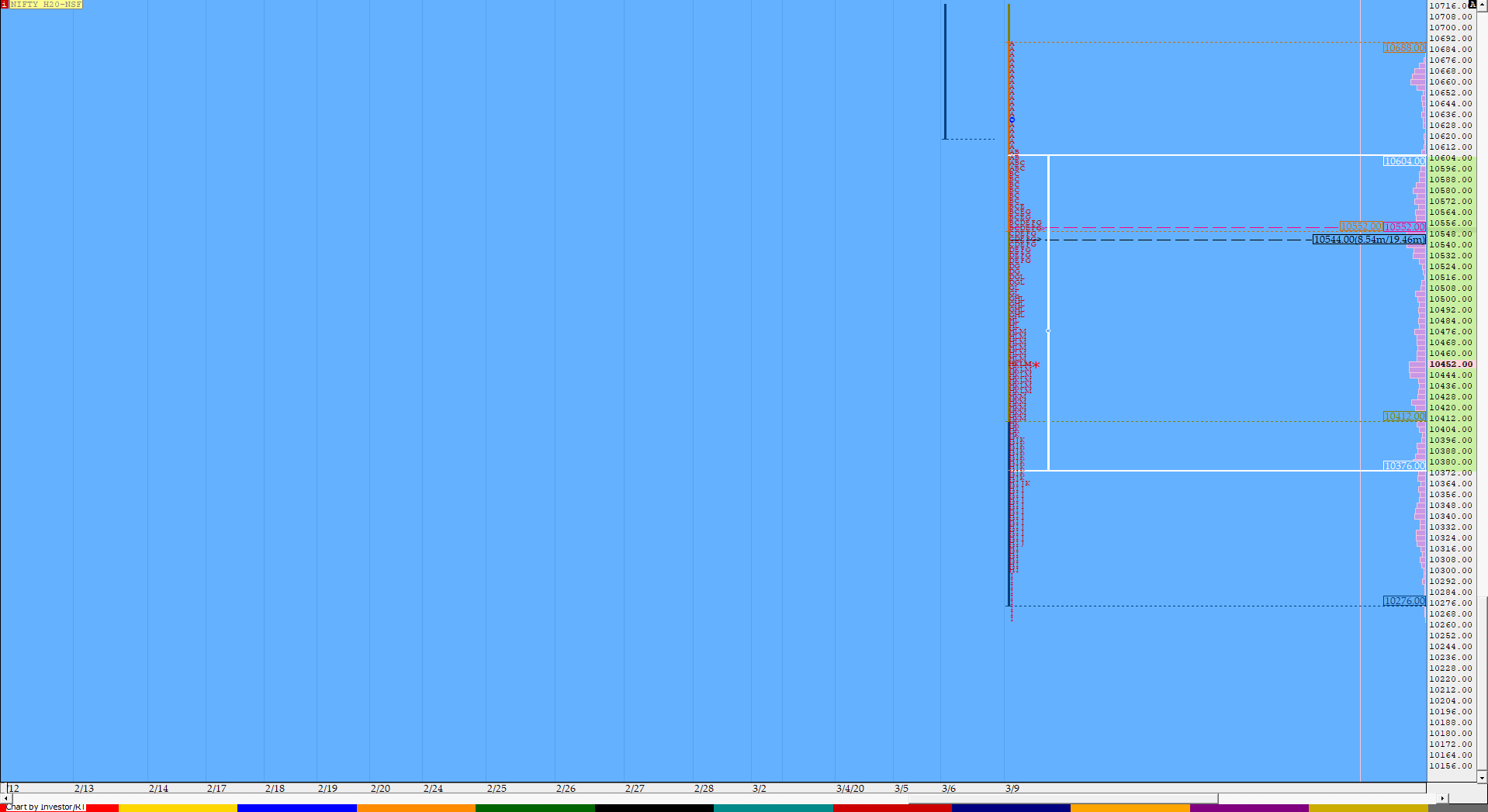

Nifty Mar F: 10462 [ 10690 / 10266 ]

HVNs – 10450 / 10544 / 10911 / 10940 / (11105) / (11145) / 11165-175 / (11250) / 11270-290

Report to be updated…

- The NF Open was an Open Auction Out of Range (OAOR)

- The day type was a Normal Variation Day – Down (NV)

- Largest volume was traded at 10544 F

- Vwap of the session was at 10462 with volumes of 288.8 L and range of 424 points as it made a High-Low of 10690-10266

- NF confirmed a FA at 10830 on 06/03 and tagged the 1 ATR move of 10997 on same day. This FA got negated on 09/03 and NF completed the 2 ATR move down of 10495

- The settlement day Roll Over point (Mar) is 11610

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 10294-10544-10547

Main Hypos for the next session:

a) NF has immediate supply at 10465-480 above which it could rise to 10520-525 / 10545-560 / 10595-615 & 10640

b) The auction has support at 10450 below which could it fall to 10410-375 / 10345-330 / 10302 & 10278-265

Extended Hypos:

c) Above 10640, NF can probe higher to 10655-662 / 10690-715 & 10740-768

d) Below 10265, the auction can move lower to 10245-236 / 10215 / 10188-175 & 10160-155

-Additional Hypos-

e) If 10768 is taken out, NF can go up to 10787 / 10815-830 / 10860-880 & 10914-940*

f) Below 10155, the auction could fall to 10139-111 / 10075-68 / 10054-030 & 10000-9978

BankNifty Mar F: 26526 [ 27244 / 25935 ]

HVNs – (26150) / 26480 / 26750 / 27560 / 27780 / 28395 / 28511 / 28835 / 28920 / 29040-090

Report to be updated…

- The BNF Open was an Open Auction Out of Range (OAOR)

- The day type was a Normal Variation Day – Down (NV)

- Largest volume was traded at 26750 F

- Vwap of the session was at 26516 with volumes of 62.1 L and range of 1309 points as it made a High-Low of 27244-25935

- The settlement day Roll Over point (Mar) is 30520

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 26231-26750-26849

Main Hypos for the next session:

a) BNF needs to sustain above 26545 for rise to 26600 / 26685-700 / 26750-803 / 26857-896 / 26935-950 & 27000-050

b) The auction has immediate support at 26480 below which it could fall to 26400-390 / 26310 / 26230-200 / 26135-100 & 26000

Extended Hypos:

c) Above 27050, BNF can probe higher to 27100-200 / 27245-280 / 27400 & 27501-560*

d) Below 26000, lower levels of 25950-930 / 25810 / 25755-730 / 25680-650 & 25575-550 could be tagged

-Additional Hypos-

e) If 27560 is taken out, BNF can go up to 27695 / 27765-780 / 27899-950 & 28000-045

f) If 25550 is taken out, the auction can fall further to 25491 / 25429-414 / 25370 / 25300-281 / 25205-180 & 25120-040

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout