The Evolution of Market Profile

It’s fascinating how Market Profile consolidates diverse trading insights under one umbrella.

The world of MarketProfile from the 70’s and 80’s has kept pace with the fast changing derivatives markets of today, incorporating the latest information available to keep a trader at par with the message of the market

At Vtrender, we’re unique in navigating all three variations of Market Profile—sometimes simultaneously, sometimes independently. Let me break this down for you.

We recognise the traditional market profile as having evolved through 3 phases

Understanding the Three Variations:

The Traditional Market Profile: This initial version focused on 30-minute segments to assess price and time, using the simple formula of time x price = value. A detailed write up is at – https://vtrender.com/decoding-market-profile-mastering-trading-through-behavioral-insights/

Steidlmayer Distribution: This update introduced the Initial Price Move (IPM), highlighting a market’s journey from an opening move, through balance, to imbalances, and back to IPM. It’s a fascinating evolution we’ve discussed in depth. you can catch the entire write up at – https://vtrender.com/steidlmayer-distribution/

SteidlMayer Volume Strips: Moving away from strict 30-minute intervals, this method uses varied timeframes to better capture market imbalances, offering a more nuanced view of market movements.

Why the Shift?

Pete Steidlmayer’s journey from the Traditional Market Profile to Volume Strips was driven by a quest to find “value” in a changing market landscape. Initially, the Market Profile’s simplicity was groundbreaking, but as trading evolved—especially with the advent of 24-hour markets and electronic trading—so did the need for a more dynamic approach.

The introduction of institutional volumes and algorithms significantly altered market dynamics, prompting Pete to adapt his methods. With exchanges now providing comprehensive volume data, the equation shifted from Price x Time to directly using Volume, offering real-time insights into market activity.

What This Means for Us

Interestingly, despite these evolutions, the core principles of Market Profile remain incredibly relevant to our trading environment, which operates within set market hours. This allows us to utilize all three of Pete’s methods effectively, applying them to our unique market context.

The Vtrender Approach

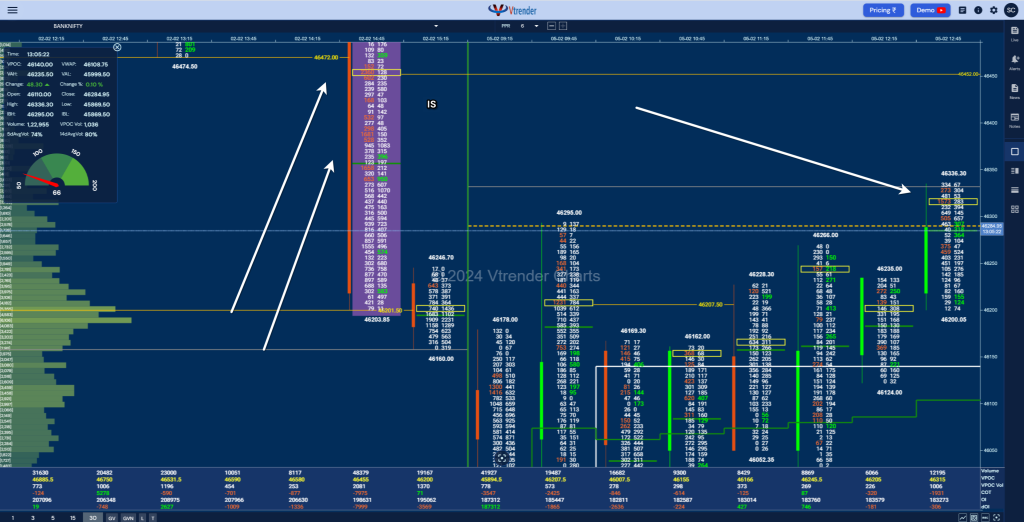

At Vtrender, we’re building on Pete’s foundational work, and we adapt and evolve our strategies to stay ahead. One significant advancement has been our embrace of Volume information through OrderFlow, which lets us peek inside candlesticks to understand market movements in real time.

In the evolving landscape of market analysis, staying ahead means continually seeking out tools that sharpen your edge. At Vtrender, we’ve pioneered this approach, blending traditional Market Profile wisdom with the cutting-edge insights provided by OrderFlow. This combination offers traders an unparalleled view into the inner workings of the market.

Why OrderFlow Matters

OrderFlow is like having X-ray vision in the world of trading. It allows you to see beyond the surface-level price movements and candlestick patterns, diving into the actual transactions and intentions driving market changes. This deeper understanding transforms how we perceive market dynamics, offering a real-time glimpse into the push and pull between buyers and sellers. The Orderflow is the real time demand and the supply of the markets. we have talked about this extensively at – https://vtrender.com/what-is-order-flow/

The Vtrender Edge: A Fusion of Market Profile and OrderFlow

Our approach at Vtrender is not just innovative; it’s transformative. We don’t merely observe the market; we decode it. By marrying Market Profile’s structured analysis of price and time with OrderFlow’s granular view of trading activity, we equip traders with a comprehensive understanding of market behavior. This synergy enables you to:

- Identify key trading opportunities with greater precision.

- Understand the strength behind market moves, distinguishing between genuine trends and noise.

- Anticipate potential reversals by observing real-time shifts in market sentiment.

you can have a look at the MarketProfile and the Orderflow charts we have at – charts.vtrender.com

A Strong Case for Adding OrderFlow to Your Arsenal

Incorporating OrderFlow into your technical analysis isn’t just an upgrade; it’s a revolution in how you trade. With this approach, you’re not guessing based on past patterns; you’re making informed decisions based on live data. This real-time insight into market dynamics is what sets apart successful traders from the rest.

Whether you’re assessing market strength, identifying potential entry and exit points, or evaluating the effectiveness of your strategies, OrderFlow provides the clarity and depth needed to make decisions with confidence. It’s this level of detail and immediacy that can mean the difference between a good trade and a great one.

get upto speed quickly with the basics of Orderflow at – https://vtrender.com/what-is-order-flow/

Orderflow charts are in the menu section at charts.vtrender.com

Join Us and Transform Your Trading

Embrace the future of trading with Vtrender. By integrating OrderFlow into your technical analysis, you’ll unlock a new dimension of market insight. Our mentoring room is not just a platform; it’s a community where forward-thinking traders converge to share, learn, and grow.

A quick look at what is on offer is at – https://vtrender.com/mentorship/

Dive deeper into the potential of combining Market Profile with OrderFlow and discover how it can revolutionize your trading strategy. With Vtrender, you’re not just keeping pace with the markets; you’re staying ahead.