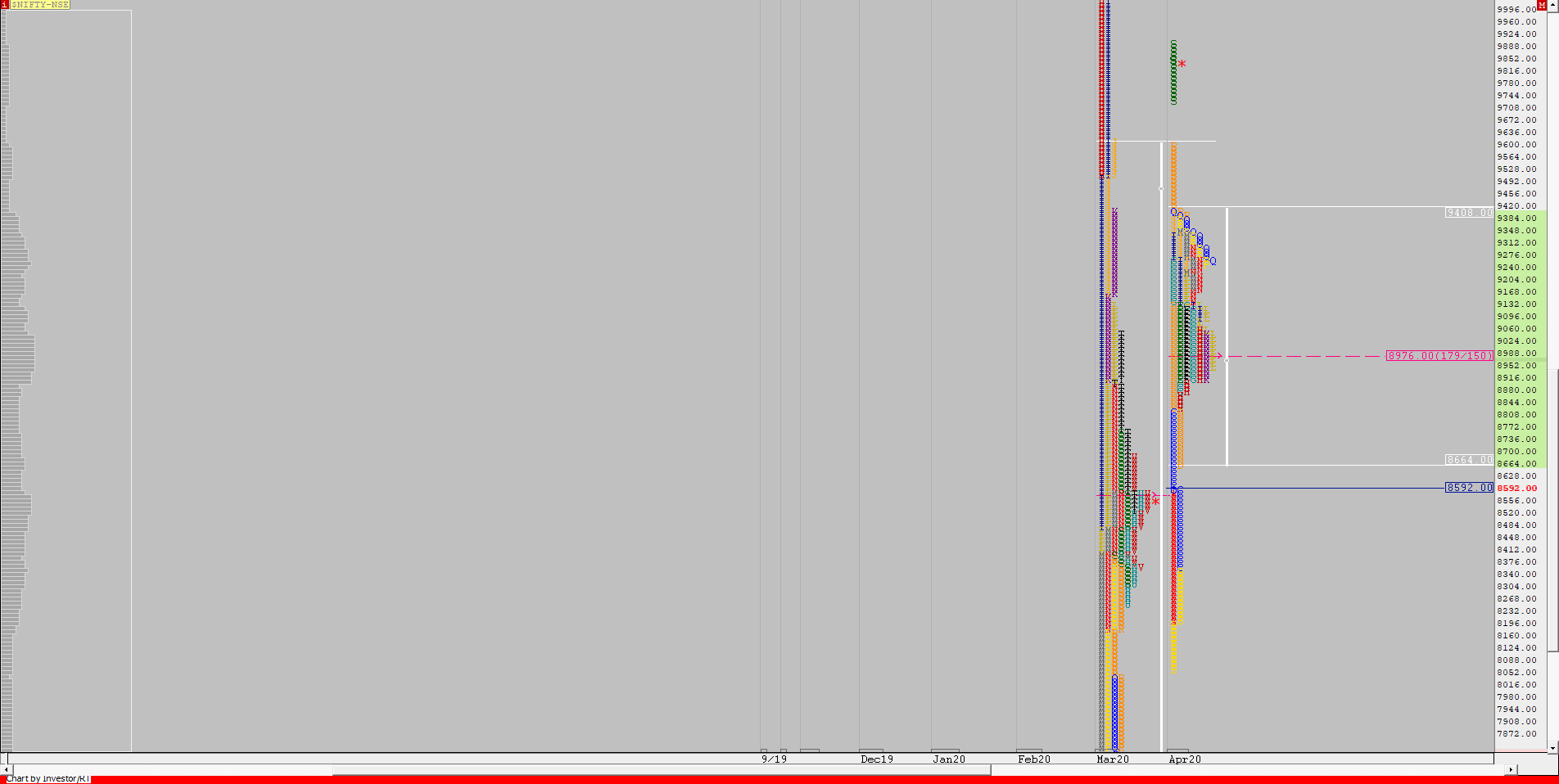

Nifty Spot – 9860 [ 9889 / 8055 ]

Monthly Profile (April 2020)

Previous month’s report ended with this ‘The monthly profile has extension handles at 11064 / 10950 & 10050 apart from couple of daily FAs at 9602 & 9404 which would be the important references on the upside in the coming month above the swing high of 9039.‘

Nifty started this month with an Open Drive Down from the monthly POC of 8592 and seemed like would continue the imbalance of March as it made lows of 8055 but formed 2 ‘b’ shape profile on the first 2 days which indicated that there was no new selling happening after which it opened the next week with a gap up leaving a Trend Day on 7th April as it made new highs at 8819 and continued to probe higher on the 8th Apr also where it made a big ‘C’ side extension of 9132 marking the end of this leg of imbalance. The auction then formed a balance over the next 10 sessions with a slow bias on the upside as it made new highs of 9391 on 20th Apr stalling right below the first daily FA of 9404 it had left in March. Nifty began the last week of April with a 2-day balance as it formed Value above the 10-day composite Value of 8912-9014-9209 and even tagged the daily FA of 9404 on the 28th as it closed near the highs indicating that a new leg higher could be coming. More confirmation came on 29th morning as the auction left a buying tail in the IB and went on to leave the second Trend Day of the month as it almost tagged the 2nd FA of 9602 confirming that the monthly profile was closing in a spike higher as there was a big gap up of 200 points on the last day of the month as Nifty made highs of 9889 forming a very nicely balanced ‘p’ shape profile on the daily to end the month marking the completion of a full cycle for the month which started with couple of ‘b’ shape profiles looking for sellers and had now reached the other end with a ‘p’ shape profile looking for fresh demand.

The monthly range of 1833 points was very much higher than average but was still inside the previous month’s range leaving a 3-1-3 balanced profile with Value at 8664-9010-9408. The tail at lows for the month is from 8198 to 8055 above which there is an extension handle at 8588 right near previous month’s POC which would be an important reference in the coming month(s). We also have a big spike reference from 9404 to 9889 which would be the first zone to see a balance being formed as the new month starts if we fail to get new demand in the coming day(s).

Click here to view the daily chart of April on MPLite as per commentary given above

Monthly Zones:

The VWAP of the April 2020 series is at 8999 spot and the POC is at 9010

The settlement day (May) rollover volume point is at 9822 F.

The VWAP of the March 2020 series is at 9146 spot and the POC is at 8592

The settlement day (Apr) rollover volume point is at 8686 F.

The VWAP of the February 2020 series is at 11944 spot and the POC is at 12125

The settlement day (Mar) rollover volume point is at 11610 F.

The VWAP of the January 2020 series is at 12178 spot and the POC is at 12132

The settlement day (Feb) rollover volume point is at 12044 F.

The VWAP of the December 2019 series is at 12087 spot and the POC is at 12182

The settlement day (Jan) rollover volume point is at 12193 F.

The VWAP of the November 2019 series is at 11954 spot and the POC is at 11910

The settlement day (Dec) rollover volume point is at 12153 F.

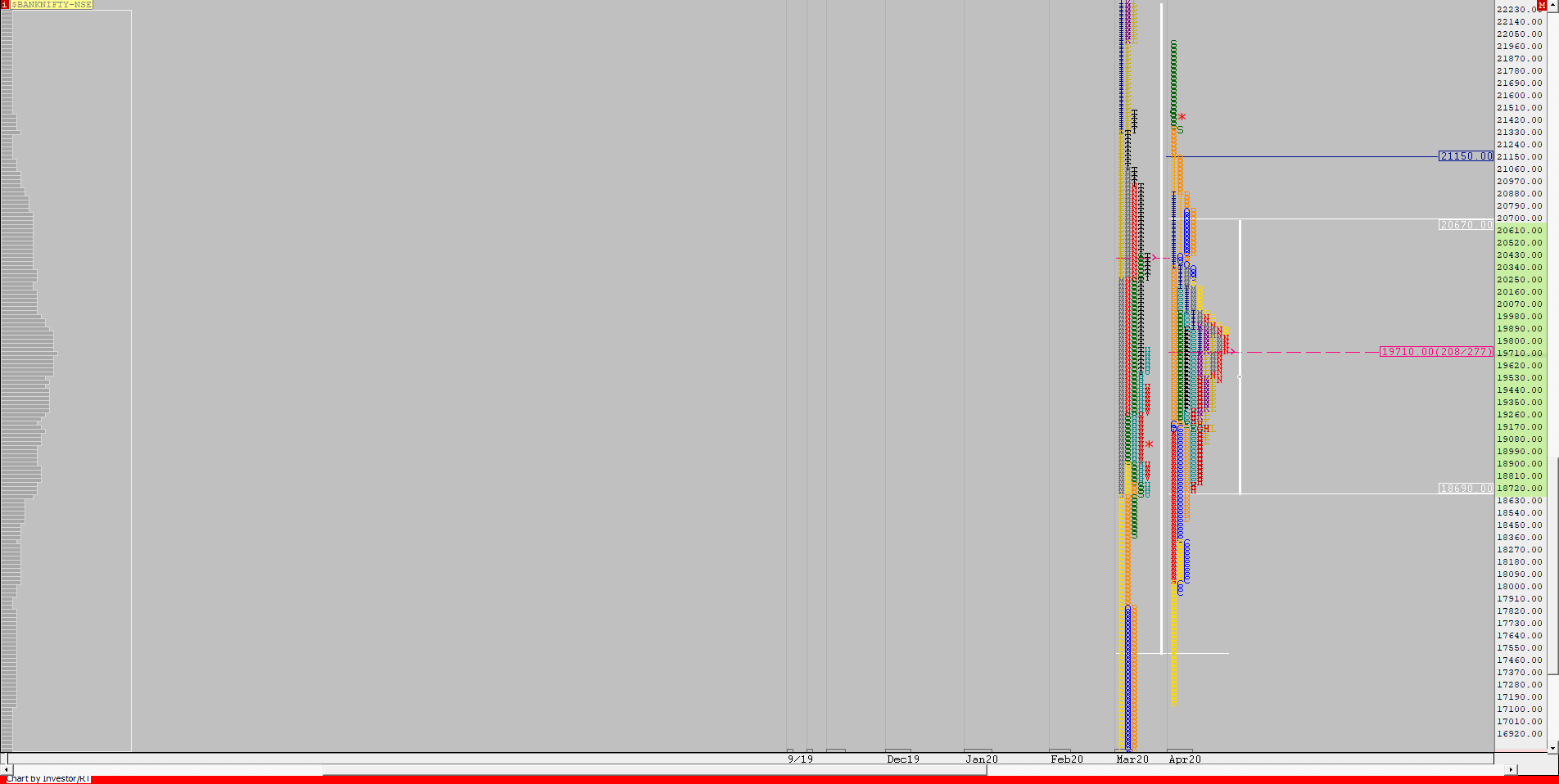

BankNifty Spot – 21534 [ 21967 / 17143 ]

Monthly Profile (April 2020)

BankNifty also opened the month with an Open Drive Down along with an almost OH (Open=High) start at 19155 and left a big selling tail in the IB to form a ‘b’ shape profile for the day as it made lows of 18042 and continued this imbalance to the downside on the next day in the form of another drive down as it formed yet another ‘b’ shape profile for the day and ended the day with a spike down breaking below the monthly VAL of 17520 as it made lows of 17143. This spike was rejected as the auction opened the next week with a big gap up of 1200 points on 7th Apr and went on to tag 18498 before it gave a retracement in which it made a C side extension and went on to confirm a daily FA at 17953 which set up the probe for a fresh move on the upside resulting in new highs for the month as it not only tagged the 1 ATR objective of 19574 the next day but also went on to make a huge C side extension testing above the monthly POC of 20248 as it made highs of 20324. This big imbalance of 3000 points in 3 days then led to a balance being formed over the next 5 sessions with a prominent POC seen at 19496. BankNifty then made an attempt to move away from this Value as it made a gap up of 1000 points on 17th April making new highs for the month as it closed as a Neutral Extreme day with a weekly spike. The next week opened higher at 21122 but formed a narrow range balanced profile closing in a spike lower indicating that the upside was getting limited and made a gap down opening on 21st Apr as it got back into that 5-day composite completing the 80% Rule as it took support at the composite VAL & formed yet another prominent POC around 19425. BankNifty then formed 2 narrow range days of just 435 & 377 points on 24th & 27th April while the auction was getting ready for a new leg of imbalance while staying above the 19424 level which meant that the PLR was to the upside and then went on to give a trending move over the last 2 days as it made new highs of 21348 for the month on 29th & went on to gap up on the last day as it hit 21967 completing the 2 ATR objective of 21555 and could not sustain above the IBH inspite of 3 attempts as it left poor highs indicating that the upside was getting exhausted and gave a Neutral Extreme close to the day on the downside confirming a FA at top which means that the PLR now would be to the downside.

The monthly profile just as in Nifty, represents a smoother 3-1-3 balance with Value at 18690-19710-20670. The buying tail at lows is from 17953 to 17143 and the the excess on the top would be the spike close of 21122 to 21967. The 1 ATR objective from the FA of 21967 also comes to around 21103 which could be the first probable move to come at the start of the new month.

Click here to view the daily BankNifty chart of April on MPLite as per commentary given above

Monthly Zones:

The VWAP of the April 2020 series is at 19605 spot and the POC is at 19710

The settlement day (May) rollover volume point is at 21380 F.

The VWAP of the March 2020 series is at 22104 spot and the POC is at 20248

The settlement day (Apr) rollover volume point is at 19380 F.

The VWAP of the February 2020 series is at 30692 spot and the POC is at 30692

The settlement day (Mar) rollover volume point is at 30520 F.

The VWAP of the January 2020 series is at 31425 spot and the POC is at 32104

The settlement day (Feb) rollover volume point is at 30726 F.

The VWAP of the December 2019 series is at 31956 spot and the POC is at 32102

The settlement day (Jan) rollover volume point is at 32180 F.

The VWAP of the November 2019 series is at 30699 spot and the POC is at 31110

The settlement day (Dec) rollover volume point is at 32160 F.