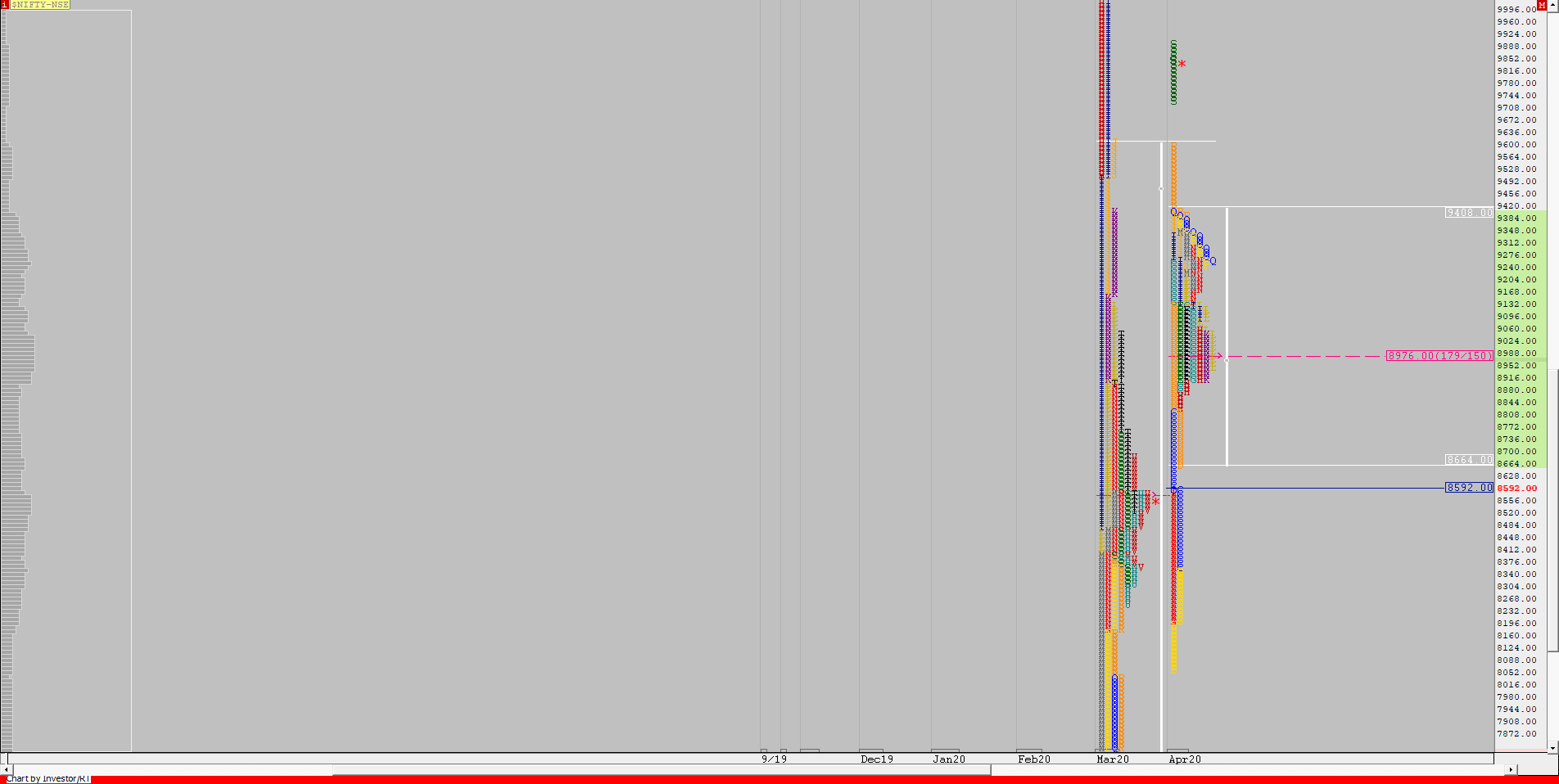

Nifty Spot – 9580 [ 9599 / 8806 ]

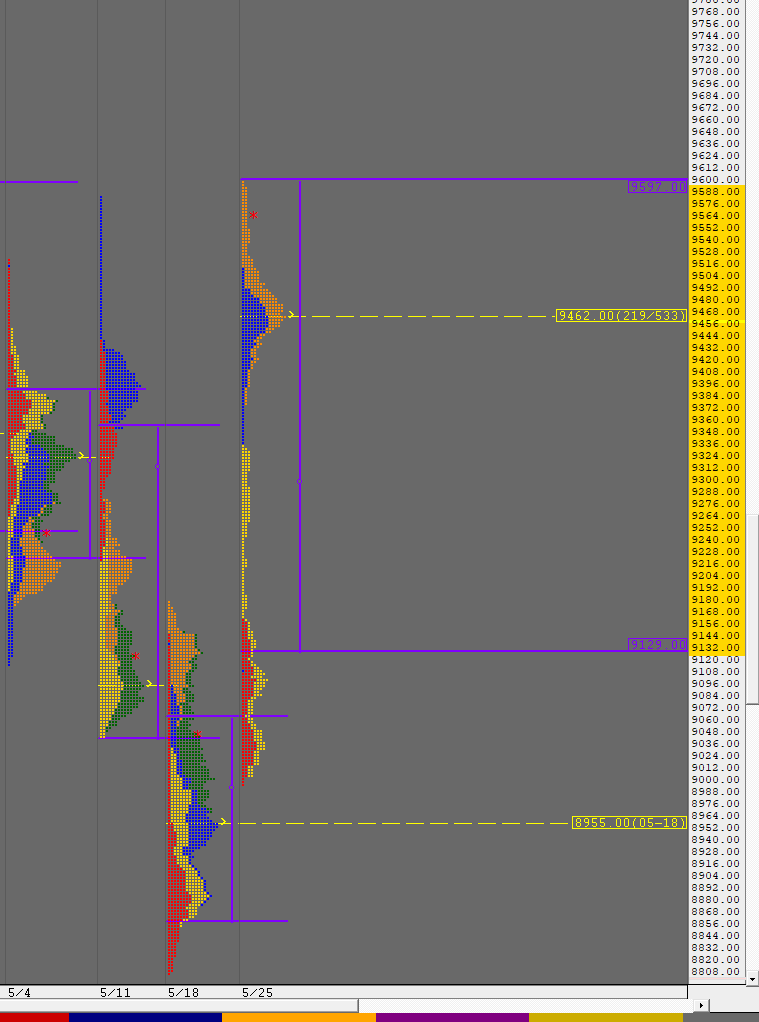

Monthly Profile (May 2020)

Previous month’s report ended with this ‘The tail at lows for the month is from 8198 to 8055 above which there is an extension handle at 8588 right near previous month’s POC which would be an important reference in the coming month(s). We also have a big spike reference from 9404 to 9889 which would be the first zone to see a balance being formed as the new month starts if we fail to get new demand in the coming day(s).

Nifty rejected the previous month’s spike close of 9860 as it not only opened with a big gap down of more than 300 points and drove lower after the OH (Open=High) start at 9533 breaking below the spike low of 9404 on the first day itself as it made lows of 9116 in the mid of the first week where it got some rejection after which it began to form a balance leaving a 3-1-3 balanced weekly profile. The second week of the month made an outside bar as it first made a new low of 9043 on 12th May but then gapped up by almost 400 points the next day where it made new highs for the month but once again left an OH at 9584 and got swiftly rejected leaving a selling tail from 9430 to 9584 at top not just on the daily but also on the weekly profile as it trended lower for the rest of the week matching the earlier low as it tagged 9050 on 15th May. The first 2 weeks or rather the 10 days formed a good composite with Value at 9204 to 9427 and the POC at 9323 and with the close at 9137 way below the VAL, the PLR was firmly to the downside with the additional confirmation of a weekly FA (Failed Auction) at 9584.

The third week of May started with a Drive Down from yet another OH start at 9158 on 18th May and saw Nifty dropping a huge 333 points in the first 5 periods as it made a low of 8825 after which the auction began to form a ‘b’ shape profile for the rest of the day which indicated that there was no new selling happening. Nifty did make a new low of 8806 on the same day in an attempt to spike lower but it got stalled right at the weekly 1 ATR objective of 8805 which was an important cue and that low held for the week as the auction probed higher not only getting accepted in the selling tail but even making a look up above it where it got swiftly rejected from 9178 to end the week with a balanced profile with lower Value but for the first time in the month the weekly close was near to the VAH rather than the VAL which was a signal that the PLR was no longer to the downside.

The last week of the month saw the auction make a weak start on Monday as it once again got rejected from that 9158 level at open as it made a high of 9161 and probed lower all day getting into the previous week’s Value but ended up stalling at 9004 & 8996 unable to even tag the weekly POC of 8955. The next day, Nifty once again made a low of 9004 in the IB which confirmed that the demand was active in this zone and this led to the first Trend Day Up for the month and this new imbalance continued till Friday as the auction went on to make new highs of the month to hit 9599 before closing the week & month at 9580.

Nifty has not only formed an inside bar on the monthly timeframe but this month’s Value at 9024-9106-9432 is also completely inside previous Value which means that Nifty is still in balance mode on the higher timeframe after the huge imbalance it saw in March but with the close at highs, June promises to be a big month.

Click here to view the daily Nifty chart of May on MPLite as per commentary given above

The four weekly profiles of May

Monthly Zones:

The VWAP of the May 2020 series is at 9200 spot and the POC is at 9106

The settlement day (Jun) rollover volume point is at 9426 F.

The VWAP of the April 2020 series is at 8999 spot and the POC is at 9010

The settlement day (May) rollover volume point is at 9822 F.

The VWAP of the March 2020 series is at 9146 spot and the POC is at 8592

The settlement day (Apr) rollover volume point is at 8686 F.

The VWAP of the February 2020 series is at 11944 spot and the POC is at 12125

The settlement day (Mar) rollover volume point is at 11610 F.

The VWAP of the January 2020 series is at 12178 spot and the POC is at 12132

The settlement day (Feb) rollover volume point is at 12044 F.

The VWAP of the December 2019 series is at 12087 spot and the POC is at 12182

The settlement day (Jan) rollover volume point is at 12193 F.

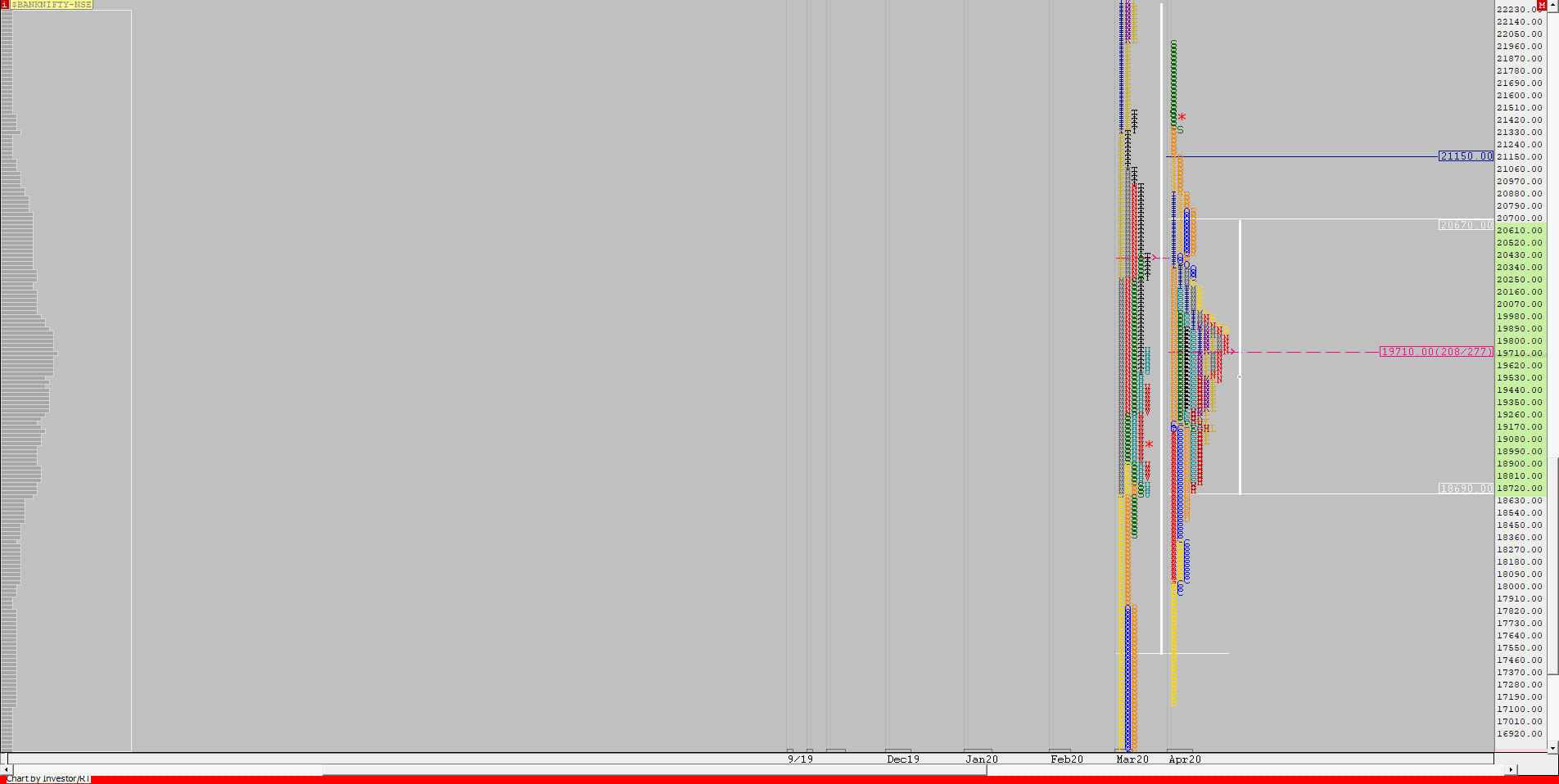

BankNifty Spot – 19297 [ 20530 / 17105 ]

Monthly Profile (May 2020)

Previous month’s report ended with this ‘The buying tail at lows is from 17953 to 17143 and the the excess on the top would be the spike close of 21122 to 21967. The 1 ATR objective from the FA of 21967 also comes to around 21103 which could be the first probable move to come at the start of the new month.

BankNifty opened a full 1000 point lower from previous month’s close of 21534 and made an drive lower, clearly the weaker of the 2 indicies as it made non-overlapping lower weekly Value for the first 3 weeks and even went on to break below previous month’s low of 17143 while making a low of 17105 on 22nd May closing the third week with a spike lower. However, this weekly spike got rejected in the last week of the month triggering a big 2000+ points short covering move as the auction made a high of 19358 before closing the month at 19297.

The monthly profile has overlapping to lower Value at 17880-19633-20100 along with a HVN at 19320 which would be the first reference on the upside for the coming month. The ability to stay above 19320 & then take out the POC of 19633 could lead to a fresh leg up in June failing which we could see a balance forming in the range of 19320 to 18780 in the coming weeks.

Click here to view the daily BankNifty chart of May on MPLite

The four weekly profiles of May

The VWAP of the May 2020 series is at 18780 spot and the POC is at 19633

The settlement day (Jun) rollover volume point is at 19035 F.

The VWAP of the April 2020 series is at 19605 spot and the POC is at 19710

The settlement day (May) rollover volume point is at 21380 F.

The VWAP of the March 2020 series is at 22104 spot and the POC is at 20248

The settlement day (Apr) rollover volume point is at 19380 F.

The VWAP of the February 2020 series is at 30692 spot and the POC is at 30692

The settlement day (Mar) rollover volume point is at 30520 F.

The VWAP of the January 2020 series is at 31425 spot and the POC is at 32104

The settlement day (Feb) rollover volume point is at 30726 F.

The VWAP of the December 2019 series is at 31956 spot and the POC is at 32102

The settlement day (Jan) rollover volume point is at 32180 F.