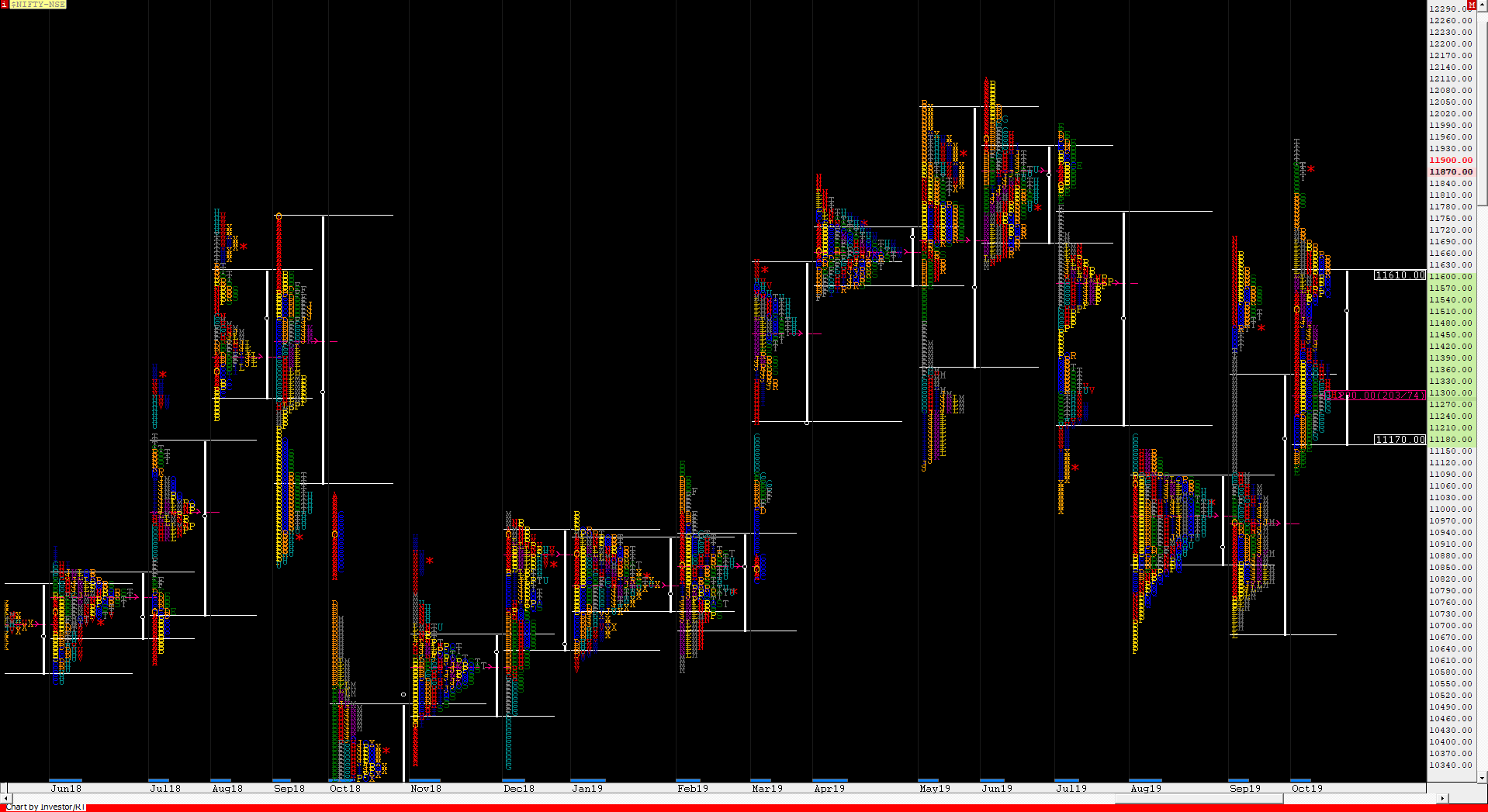

Nifty Spot – 12056 [ 12159 / 11802 ]

Monthly Profile (November)

After 2 bigger range months in September & October, it was time for Nifty to consolidate in November as it opened in the Neutral Extreme reference of the previous month’s profile which was from 11714 to 11945 while making a low of 11843 on the first day after which it made multiple attempts to probe higher in the first week leaving higher highs on 4 of the 5 days but kept getting rejected and even confirmed a monthly FA (Failed Auction) at 12034 as it made new lows for the month on the 13th followed by the 4th consecutive lower low on daily as it tagged 11802 on 14th where it was met with swift rejection just above the POC of the Trend Day Up profile of 29th Oct which was a bullish signal. The auction then made a slow probe higher and went on to make new highs for the month at 12039 on 20th Nov not only negating the earlier FA of 12034 but also confirmed a new monthly FA at 11802. Nifty however closed the third week of the month also in a balance with overlapping Value forming a nice Gaussian profile on the 16-Day composite with Value at 11865-11917-11978 (Click here to view the daily composite on MPLite). The last week of the month then started with a Trend Day Up on 25th Nov making an initiative move away from the balance as it left a weekly VPOC at 11892 along with a composite VPOC at 11917 as it first made new highs for the month at 12084 and followed it up by making new All Time Highs of 12158 on 28th before closing the month at 12056 leaving the second most narrowest monthly range of the year 2019 of just 356 points forming a balanced profile but with completely higher Value at 11870-11910-12030. The PLR for the last month of the year would be on the upside as long as Nifty stays above 12030 for probable targets of 12380 & 12463 which are the 2 ATR & 1 ATR objectives of the monthly FA’s of 11090 & 11802 respectively. On the downside, an entry back into monthly Value could trigger the 80% Rule for a probe to 11910 & 11870.

Click here to watch all the monthly profile charts of 2019

Monthly Zones:

The VWAP of the November series is at 11954 spot and the POC is at 11910

The settlement day (Dec) rollover volume point is at 12153 F.

The VWAP of the October series is at 11461 spot and the POC is at 11365

The settlement day (Nov) rollover volume point is at 11970 F.

The VWAP of the September series is at 11127 spot and the POC is at 10960

The settlement day (Oct) rollover volume point is at 11630 F.

The VWAP of the August series is at 10966 spot and the POC is at 10984

The settlement day (Sep) rollover volume point is at 11010 F.

The VWAP of the July series is at 11547 spot and the POC is at 11576

The settlement day (Aug) rollover volume point is at 11315 F.

The VWAP of the June series is at 11833 spot and the POC is at 11714

The settlement day (Jul) rollover volume point is at 11915 F.

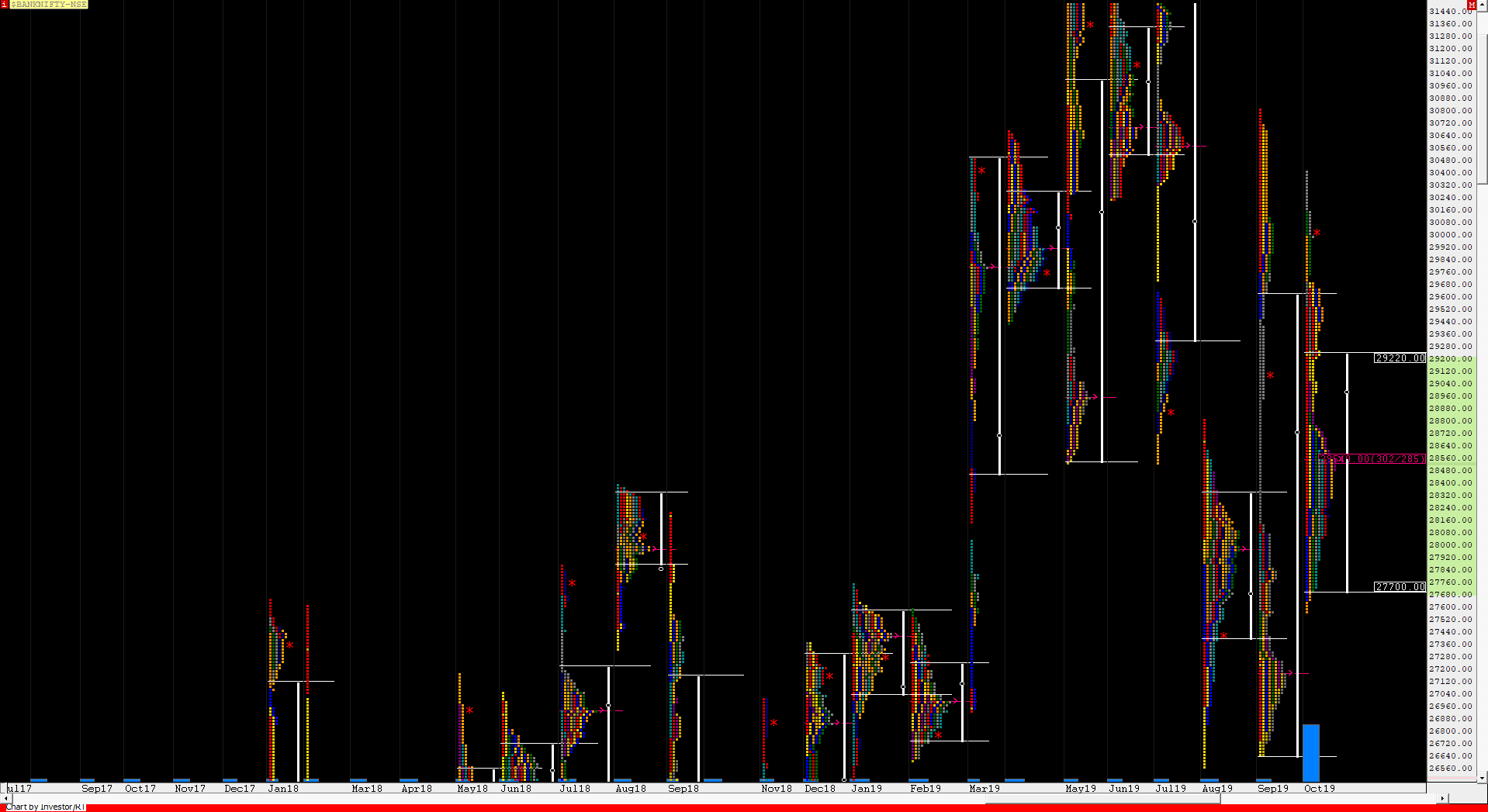

BankNifty Spot – 31946 [ 32157 / 30013 ]

Monthly Profile (November)

BankNifty had closed the previous month in a spike higher which was accepted at open this month as it went on to get above previous month’s high on the first Monday itself which was a strong signal as the previous month was also an inside bar. More confirmation that the PLR for the month would continue to remain up came when the auction confirmed a FA on both weekly as well as the monthly time frame at 30013 on 6th November which triggered a trending move all month as it made higher highs & higher lows in all the 4 weeks with the last week giving a fresh move on the upside & forming the biggest weekly range as it made new all time highs at 32157 almost tagging the 1 ATR objective from the monthly FA which was at 32165. Having completed such a large objective of more than 2000 points in just 17 sessions, BankNifty made a small retracement to close the month at 31946 which was a bit off the highs but still on the monthly scale it has yet again closed in an imbalance so can expect more upside in the coming month. Value for the month was higher with a huge gap of more than 1000 points at 30320-31110-31400 and the immediate reference for the coming month would be the zone of 31590 to 32158 and being a Trend Up profile, this month’s VWAP of 30699 with be an important positional reference for the month(s) to come.

Click here to watch all the monthly profile charts of 2019

Monthly Zones:

The VWAP of the November series is at 30699 spot and the POC is at 31110

The settlement day (Dec) rollover volume point is at 32160 F.

The VWAP of the October series is at 28784 spot and the POC is at 28415

The settlement day (Nov) rollover volume point is at 30150 F.

The VWAP of the September series is at 28416 spot and the POC is at 27160

The settlement day (Oct) rollover volume point is at 30230 F.

The VWAP of the August series is at 27858 spot and the POC is at 27960

The settlement day (Sep) rollover volume point is at 27450 F.

The VWAP of the July series is at 30425 spot and the POC is at 30560

The settlement day (Aug) rollover volume point is at 29250 F.

The VWAP of the June series is at 30914 spot and the POC is at 30961

The settlement day (Jul) rollover volume point is at 31400 F.