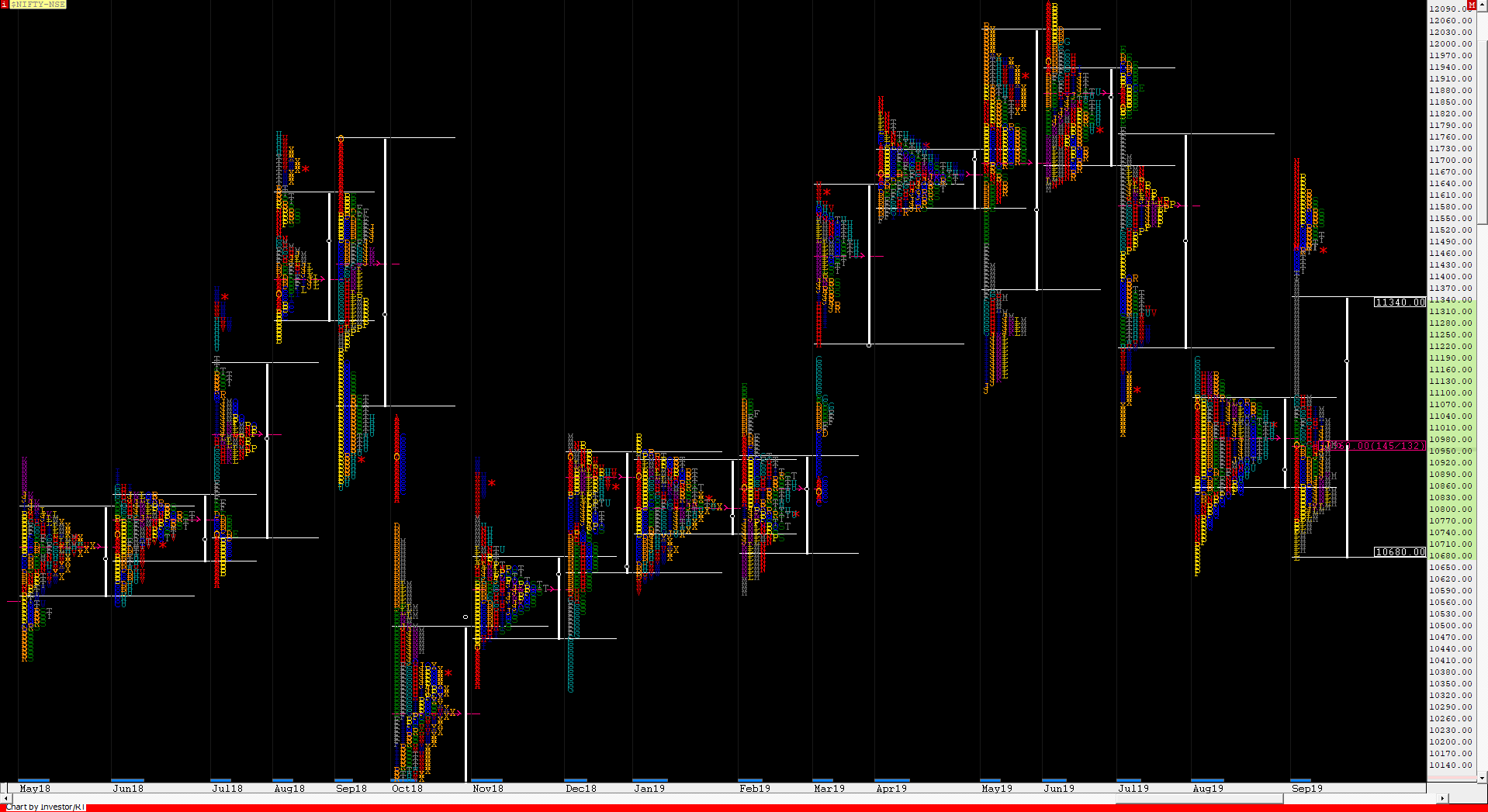

Nifty Spot – 11474 [ 11695 / 10670 ]

Monthly Profile (September)

Previous month’s report ended with this ‘The monthly Value was completely lower at 10856-10984-11080 with good chance that the next month could bring in an imbalance with a probable first target of 11258 on the upside if Nifty manages to sustain above 11080 which would also be the 1 ATR objective from the monthly FA. However, Nifty would remain weak if stays below 10984 for a test of 10870 below which it could move further down to test the recent lows & the FA of 10637 which if breaks could open up 10016 on the downside in the coming month(s).’

Nifty opened the month with a gap down below previous month’s POC of 10984 & went on to leave a Trend Day Down making lows of 10773 on the first day closing well below previous month’s Value setting up for more downside and made new lows of 10746 on 4th Sep where it left a FA on the daily time frame indicating that the auction could be reversing which it did as over the next 6 days Nifty got back into the previous month’s Gaussian profile & completed the 80% Rule as it tagged 11084 on 13th September. However, the auction got rejected from the look up above 11080 on 2 consecutive days and promptly did a reverse 80% Rule in the monthly Value leaving another Trend Day Down on 17th Sep as it made lows of 10796. This weakness continued on 19th Sep after an inside day on the 18th as Nifty gave the third Trend Day Down of the month as it made new lows for the month at 10670 and looked set to test the previous month lows of 10637. However, what happened on 20th September was totally unexpected as Nifty opened a bit higher and went on to make the biggest range of 691 points in a single day in the past 10 years as it not only made new highs for the month confirming a new monthly FA at 10670 but went on to scale above the previous month’s high of 11181 and even tagged the 1 ATR objective of 11291 from 10670 while making a high of 11382. This imbalance continued on 23rd Sep in the form of a big gap up of more than 250 points as Nifty continued to probe higher making highs of 11695 but closed lower at 11600 suggesting that the imbalance of more than 1000 points in 2 days could be giving way to a balance being formed. This was further confirmed with Nifty making an inside day on the 24th after which it probed lower on 25th September getting into the gap zone of 11471 to 11274 as it made lows of 11416 where it took support as it opened higher the next day and tagged 11611. The auction left another inside day on 27th making the balance it was forming smoother and on the last day of the month, Nifty tested that gap zone once again by making a lower low of 11391 but once again was net with rejection to close the month at 11474 leaving a Double Distribution (DD) Trend Up profile with the singles of 11085 to 11390 separating the 2 distributions. Value for the month was completely outside at 10680-10960-11340 and as this monthly DD is in middle of previous range, there is good chance of these singles being revisited in the coming month.

Monthly Zones:

The vwap of the September series is at 11127 spot and the POC is at 10960

The settlement day (Oct) rollover volume point is at 11630 F.

The vwap of the August series is at 10966 spot and the POC is at 10984

The settlement day (Sep) rollover volume point is at 11010 F.

The vwap of the July series is at 11547 spot and the POC is at 11576

The settlement day (Aug) rollover volume point is at 11315 F.

The vwap of the June series is at 11833 spot and the POC is at 11714

The settlement day (Jul) rollover volume point is at 11915 F.

The vwap of the May series is at 11613 spot and the POC is at 11696

The settlement day (Jun) rollover volume point is at 11980 F.

The vwap of the April series is at 11641 spot and the POC is at 11656

The settlement day (May) rollover volume point is at 11878 F.

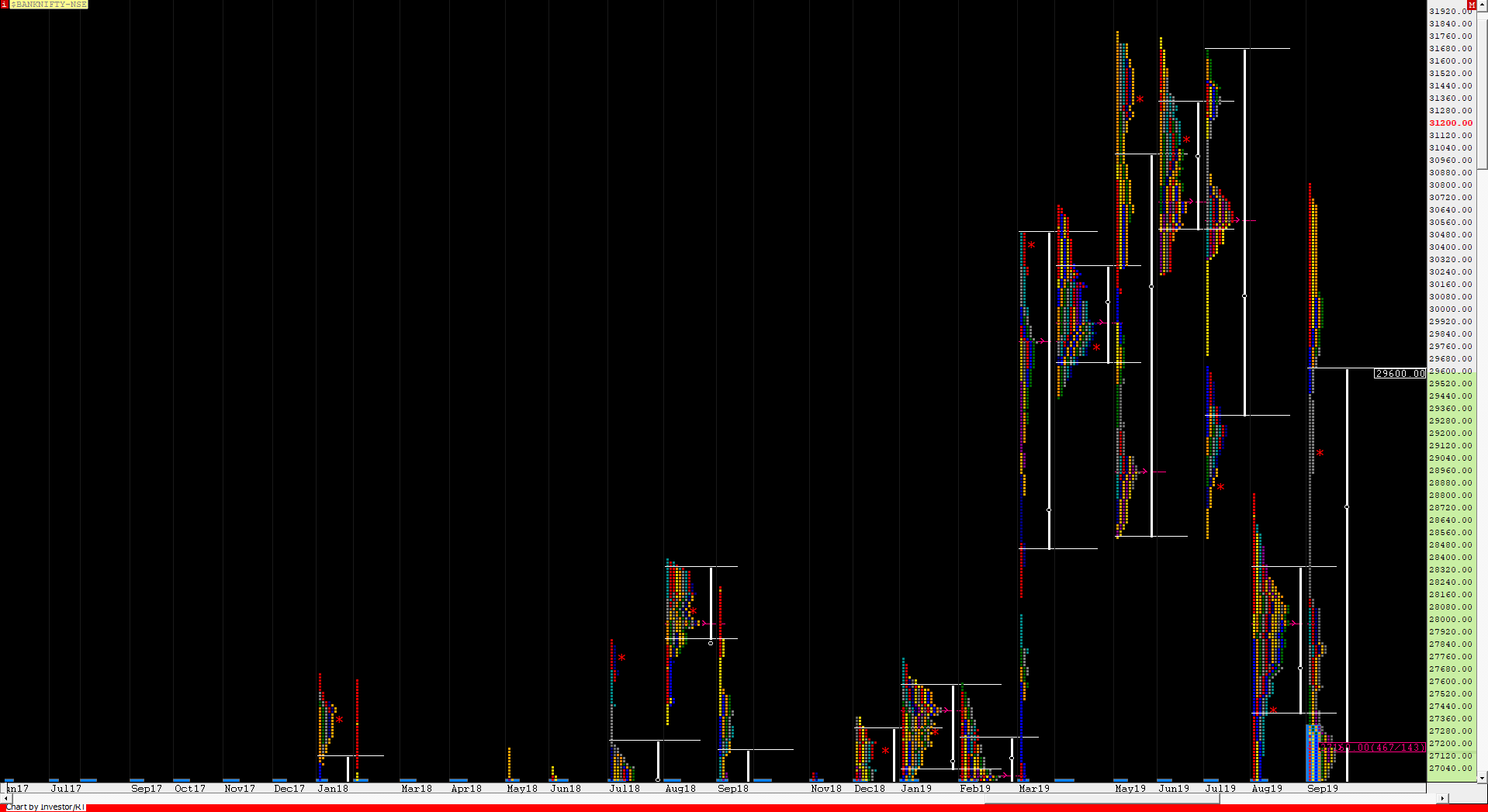

BankNifty Spot – 29103 [ 30801 / 26641 ]

Monthly Profile (September)

BankNifty made a weak opening for the month as it remained below previous month’s Value for the first week with a high of 27311 & a low of 26641 after which it got above previous month’s VAL of 27400 on 9th Sep and probed higher for 4 days tagging the POC of 27960 as it made highs of 28127 on 13th Sep looking set to complete the 80% Rule on monthly time frame with 28320 being the VAH of last month as it closed the week at 28099. The auction however retraced this entire move up the following week after a gap down opening as it made similar lows of 26643 on 19th Sep leaving poor lows on the monthly profile which seemed like would be repaired sooner rather than later but BankNifty had completely opposite plans as it not only opened higher the next day but went on to make an unprecedented range of 2691 points in a single day as it marked highs of 29419 on 20th Sep before closing the week at 28981. The imbalance to the upside continued the following week as it opened at 30039 with a gap up of more than 1000 points and continued the spectacular rise as it went on to tag the July monthly VPOC of 30560 while making a high of 30801 on the 23rd. BankNifty then made a balance for the rest of the week as it even tested the gap zone of 29848 to 28981 while making a low of 29470 on 25th Sep and gave a big spike the next day to 30718 which was very swiftly rejected to close at 29876 on Friday, the 27th. The last day of the month saw the auction making a ‘b’ shape profile indicating that all the long were liquidating as BankNifty once again got into the singles of 29470 to 28981 and this time made the entire stretch as it made lows of 28943 before closing the month at 29103. Even though the monthly range was 4160 points, the close was not at all bullish with Value at 26646-27160-29600 so there is more chance of the auction staying in this Value with a test of the POC of 27160 coming up.

Monthly Zones:

The vwap of the September series is at 28416 spot and the POC is at 27160

The settlement day (Oct) rollover volume point is at 30230 F.

The vwap of the August series is at 27858 spot and the POC is at 27960

The settlement day (Sep) rollover volume point is at 27450 F.

The vwap of the July series is at 30425 spot and the POC is at 30560

The settlement day (Aug) rollover volume point is at 29250 F.

The vwap of the June series is at 30914 spot and the POC is at 30961

The settlement day (Jul) rollover volume point is at 31400 F.

The vwap of the May series is at 30211 spot and the POC is at 28940

The settlement day (Jun) rollover volume point is at 31644 F.

The vwap of the April series is at 30037 spot and the POC is at 29850

The settlement day (Apr) rollover volume point is at 29760 F.