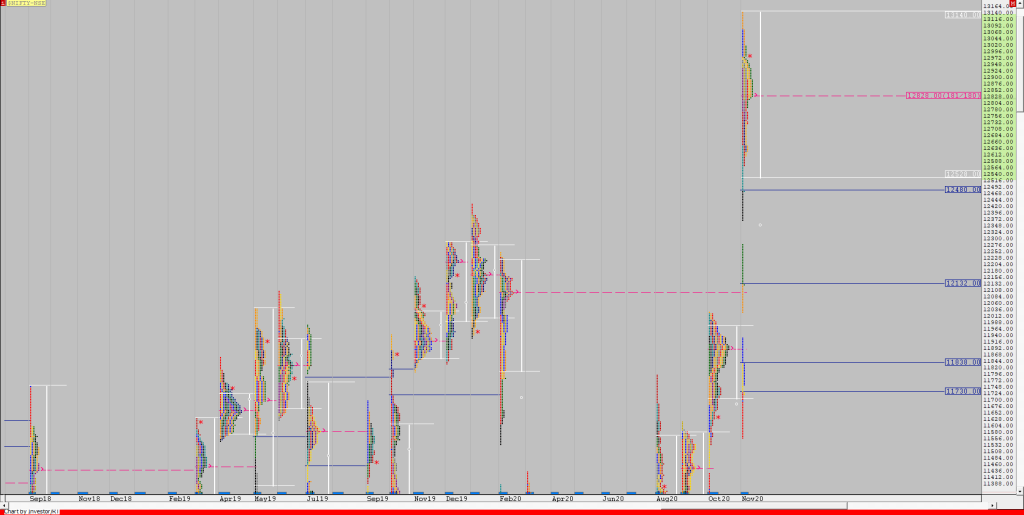

Weekly Charts (07th to 11th December 2020) and Market Profile Analysis

Nifty Spot Weekly Profile (07th to 11th Dec 2020) Spot Weekly – 13514 [ 13579 / 13242 ] Previous week’s report ended with this ‘The weekly profile looks like a balanced one with completely higher Value at 13050-13080-13206 but has closed in an imbalance around the highs which can continue at open in the coming […]

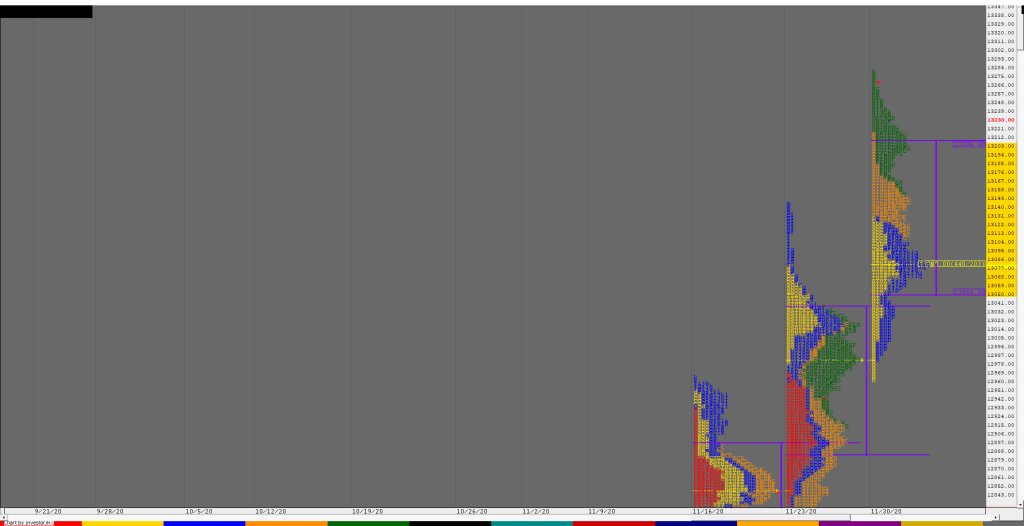

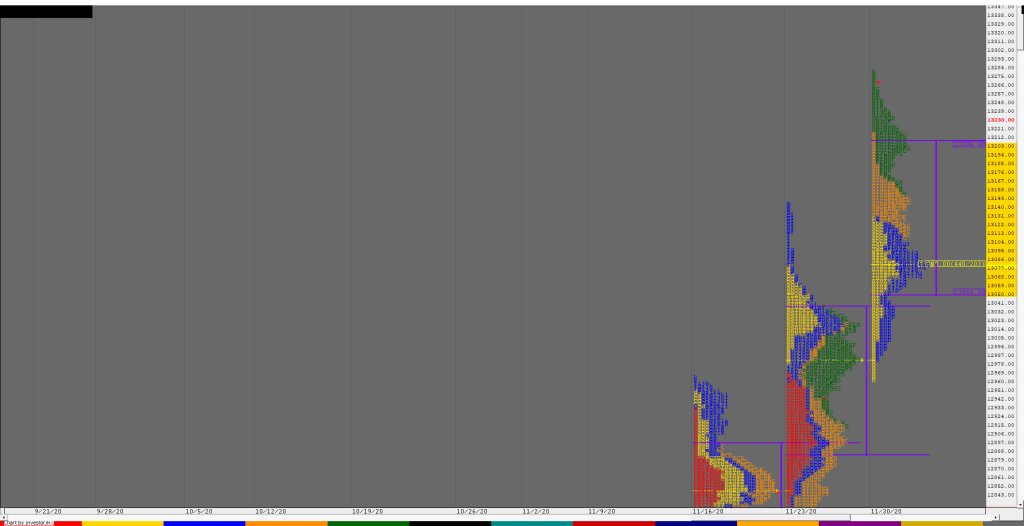

Order Flow charts dated 11th December 2020 (5 mins)

Vtrender helps you to stay on top of the Market by understanding Order Flow. This increases your flexibility, your data analysis capability and your winning trade signals. And you make your existing systems better. NF BNF

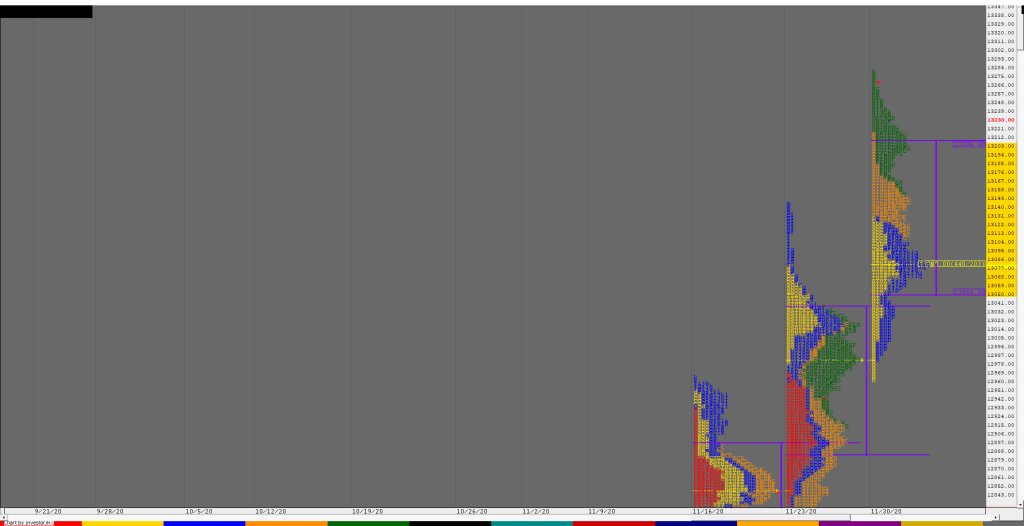

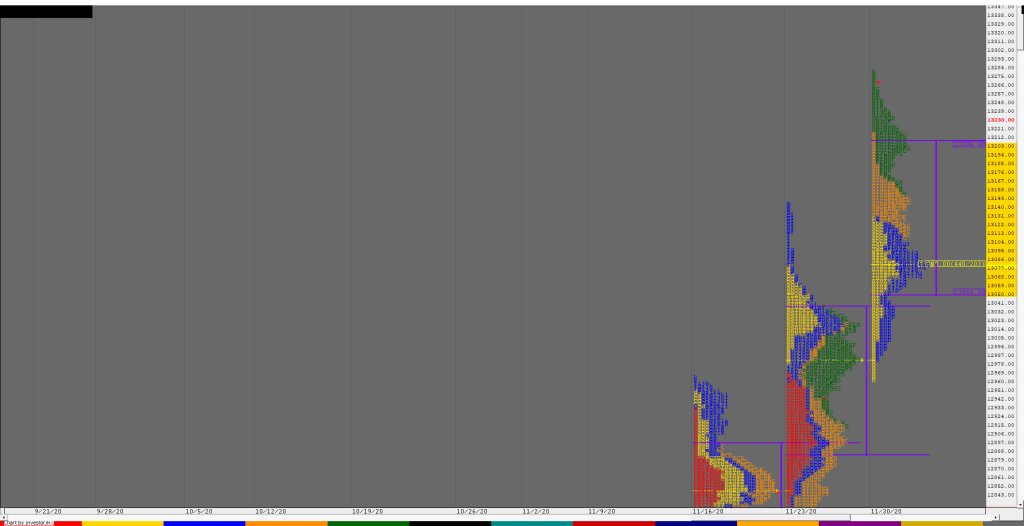

Order Flow charts dated 11th December 2020

The key to using Order Flow trading is to determine market depth. This describes the places where Market participants have taken positions or the zone they have transacted. The Order Flow is like a list of trades and helps to know how other traders are placed in the market. Vtrender helps you to stay on […]

Market Profile Analysis dated 10th December 2020

Nifty Dec F: 13524 [ 13544 / 13425 ] NF made a gap down below the lower HVN of 13510 and was rejected from 13520 in the probe higher at open as it gave a swift move lower in the IB (Initial Balance) even breaking below PDL (Previous Day Low) as it hit 13440. The […]

Order Flow charts dated 10th December 2020

Trading Order Flow allows a trader to see the specific price where a trade has hit the market, along with the volume of that trade. This information is extremely valuable and allows a trader to generate substantial revenue by using this information to trade. The way we see it is that Order Flow trading is […]

Market Profile Analysis dated 09th December 2020

Nifty Dec F: 13568 [ 13588 / 13456 ] NF gave another strong open with an OL (Open=Low) start at previous VAH and left a buying tail in the IB (Initial Balance) from 13482 to 13456 as it made an OTF (One Time Frame) probe higher till the ‘F’ period where it made highs of […]

Order Flow charts dated 09th December 2020

A good trader is a one who can make money consistently over a longer period of time. But how to become one such trader, who can make money in any type of market condition? A good trader keeps a close watch on the current information of the market and assesses it for change against previous […]

Market Profile Analysis dated 08th December 2020

Nifty Dec F: 13428 [ 13469 / 13352 ] NF opened higher but tested the yPOC of 13384 in the opening minutes as it made a low of 13381 and drove higher in the IB as it hit 13456 after which the auction made that dreaded C side extension forming new highs of 13464 which […]

Order Flow charts dated 08th December 2020

Many traders are used to viewing volume as a histogram beneath a price chart. This approach shows the amount of volume traded below the price Bar. The Order Flow approach is to see the Volume traded inside or within the price bar, an important distinction. Order Flow trading is thinking about what order market participants […]

Market Profile Analysis dated 07th December 2020

Nifty Dec F: 13387 [ 13398 / 13266 ] NF opened lower below the spike zone of 13285 to 13327 but made an almost OL (Open=Low) start at 13268 and the defending of Friday’s POC of 13260 indicated the presence of demand as the auction made a swift move back into the spike zone & […]