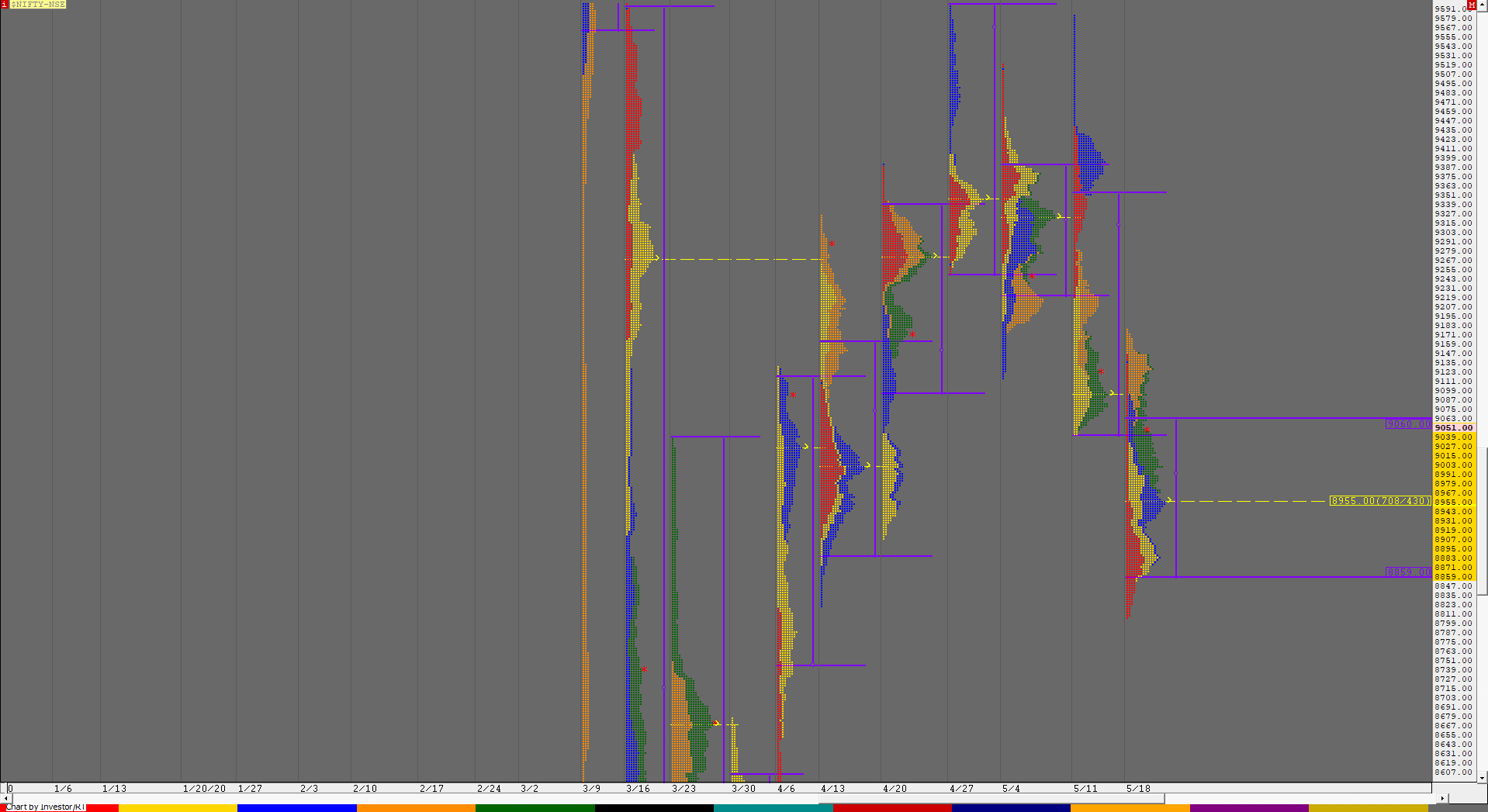

Nifty Spot Weekly Profile (18th to 22nd May 2020)

Spot Weekly – 9039 [ 9178 / 8806 ]

Previous week’s report ended with this ‘This week’s Value was at 9045-9090-9345 and as mentioned at the start, we have a nice 4-week composite in Nifty with Value at 9145-9316-9427 and the close below the VAL along with the weekly FA has set up the auction for a good move away from here to the downside towards the 1 ATR target of 8805 in the coming week(s) once it takes out the 9044 level. The immediate references on the upside would be 9169-9186′‘

Nifty Opened the week with an Open Drive Down from an OH (Open=High) of 9158 which was just below the reference of 9169-9186 as it not only moved away from previous week’s Value but went on to almost hit that 1 ATT objective of 8805 from previous week’s FA of 9584 on Monday itself but closed as a ‘b’ shape profile with a long selling tail from 8957 to 9158 but not much range extension on the downside which indicated that there was no new selling coming in. The auction then made a slow retracement over the next 2 days getting accepted in the previous day’s tail as it formed overlapping to higher Value after being rejected from just above Monday’s VAL and spiked higher into the close on Wednesday getting back into previous week’s Value. It continued this imbalance on Thursday as it not only negated the entire zone of singles but even made new highs for the week at 9178 but got stalled right in that reference of 9169-9186 as it left similar highs here which confirmed presense of supply here and this led to a move lower on Friday as Nifty moved away from the prominent POC of 9131 forming lower Value on daily for the first time in the week but got stalled at 8968 just above the 2-day composite vPOC of 8950 once again ended up as a ‘b’ shape profile for the day. The weekly profile was once again a Neutral one but this time a Neutral Centre with mostly lower Value at 8859-8955-9060 but a close around the VAH which does not give any clear bias for the coming week as looks like the auction is locked in a range which could continue in the coming exiry week before we get a good move away from longer time frame monthly balance we have been forming. Incidentally, Nifty gave the narrowest weekly range in 13 weeks of just 372 points and could give another smaller range week before we see a range expansion happening in June.

Click here to view this week’s auction in Nifty with respect to previous week’s profile on MPLite

Main Weekly Hypos for Nifty (Spot):

A) Nifty has immediate resistance at 9060-87 above which it could rise to 9121-31 / 9173-86 / 9214* / 9265-81 / 9323*45 & 9386*-9409

B) The auction would get weaker below 9025 for a probable test of 8979-50* / 8927 / 8875-55 / 8805-8790 / 8748*-8696 & 8649

Extended Weekly Hypos

C) If 9409 is taken out, Nifty can probe higher to 9458 / 9497-9507 / 9555-9605 / 9654-81 / 9703-52 & 9801

D) Break of 8649 could bring lower levels of 8599-40 / 8510-9499 / 8445* / 8413-8394 / 8363-25 & 8282

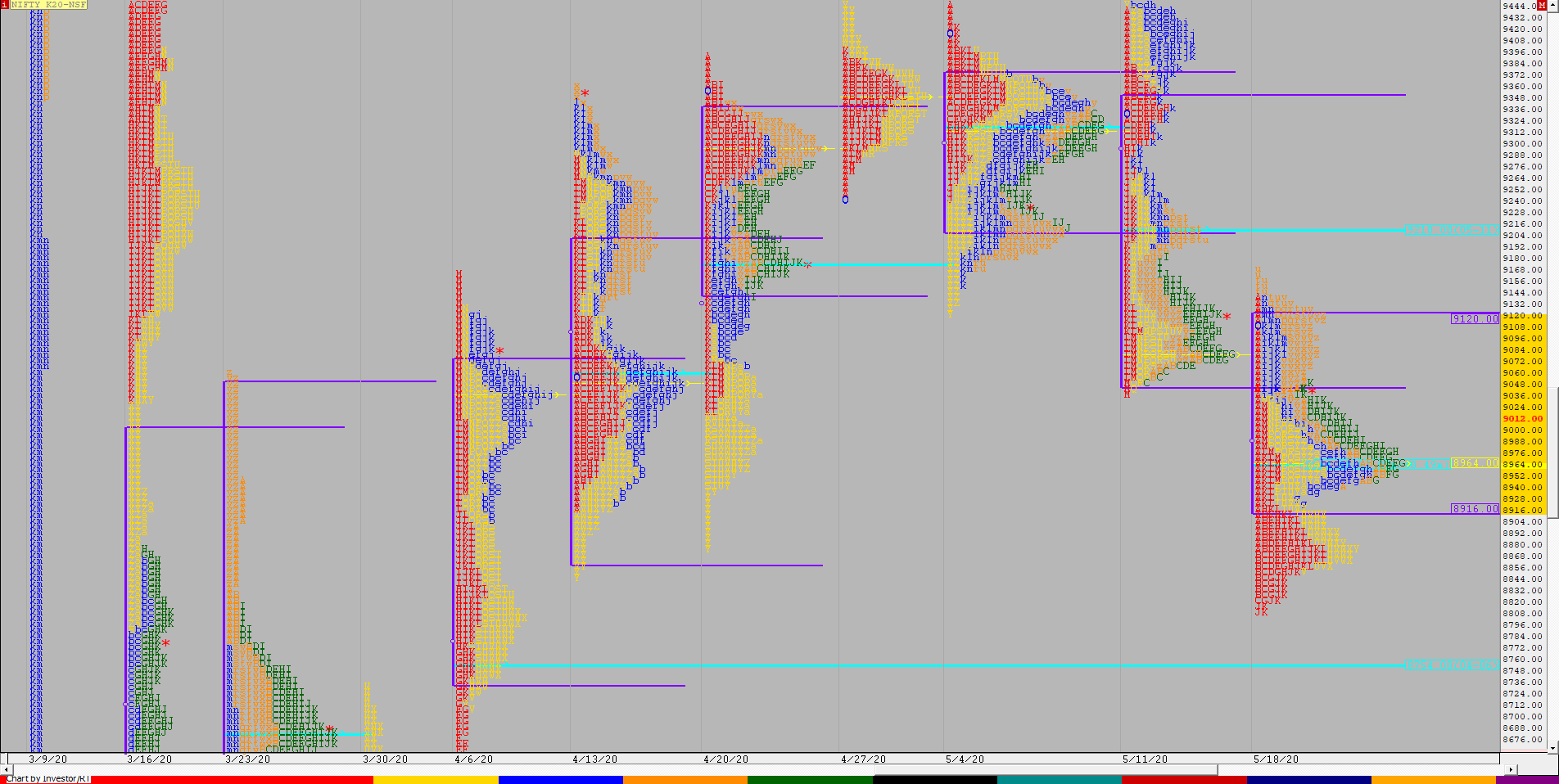

NF (Weekly Profile)

9028 [ 9170 / 8811 ]

NF started the week with an initiative move to the downside as it fell by more than 300 points on Monday and looked like will tag the 1 ATR target of 8760 from previous week’s FA of 9557 but got stalled at 8811 as it completed the objective of 8805 in Spot after which it started to make a slow probe higher with overlapping to higher Value on Tuesday & Wednesday tagging 9170 on Thursday stopping right below the multi-day FA of 9180 which marked the end of the upside auction. Friday saw a move lower as NF made a ‘b’ shape profile forming lower Value on the daily as it made lows of 8940 before closing the week at 9028. The weekly profile which was a balanced one with a narrow range of just 359 points has also formed lower Value at 8916 to 9120 with a prominent POC at 8964 and would need big volumes to move away from this zone in the coming week(s).

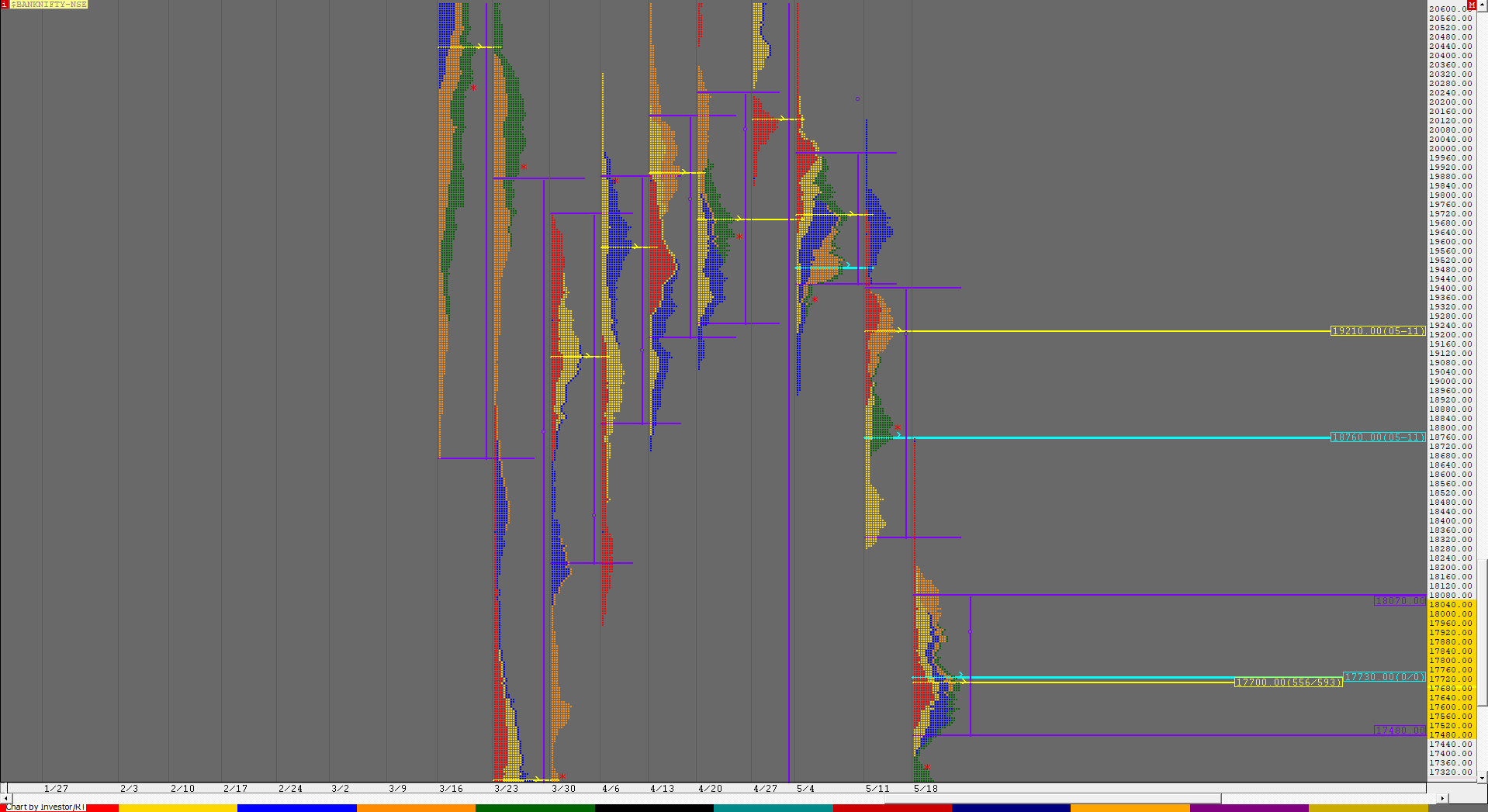

BankNifty Spot Weekly Profile (18th to 22nd May 2020)

Spot Weekly – 17279 [ 18795 / 17105 ]

Previous week’s report ended with this ‘The weekly profile is an elongated trending one down with multiple distributions and a selling tail at top with mostly lower Value at 18680-19200-19680. The multiple distributions have ensured couple of other HVNs at 18760 & 19631 which would be important references for the coming week with the PLR being to the downside but BankNifty would need a decisive break of 18680 first and then needs to take out this week’s low for probable targets of 17980 and 17594 which is the 1 ATR objective from the weekly FA of 20122‘

BankNifty began this week with an Open Drive Down and an OH (Open=High) start from just above previous week’s HVN of 18760 as it trended lower on Monday for the first 5 periods and went on to complete the 1 ATR objective of 17594 as it made lows of 17514 and closed the day as a ‘b’ shape profile with a long selling tail from 18025 to 18795. The auction then tested this selling tail on Tuesday as it made a RE (Range Extension) on the upside but got rejected at 18175 after which it went on to make new lows for the week at 17390 leaving a Neutral Extreme Day but for the second consecutive day could not give a meaningful range extension on the downside which indicated that the supply was getting exhausted which was further confirmed in the ‘A’ period of Wednesday as it left a similar but slightly higher low of 17407 which changed the shorter term PLR (Path of Least Resistance) to the upside. The auction probed higher till Thursday afternoon as it got into Monday’s selling tail for the second time in the week but once again was rejected from 18200 to leave a second Neutral Extreme Day in 3 days which indicated that there was an equal fight happening between buyers & sellers in which the latter were gaining the advantage though the Vaule for the first 4 days was overlapping giving a nice 4-day composite with Value at 17458 to 17938. BankNifty remained exactly in this Value on Friday in the Initial Balance with extremes at 17952 & 17424 but moved away from here in the ‘C’ period as it left an extension handle at 17424 on the daily along with another one on the weekly at 17390 but like had happened all week, failed to even tag the 2 IB objective for the day on the downside as it made similar lows of 17116 & 17105 to leave yet another ‘b’ shape profile on the daily time frame before closing the week at 17279.

In fact, the weekly profile also represents a ‘b’ shape with a spike lower indicating long liquidation happening with the Value also being formed completely lower at 17480-17730-18070. The spike zone of 17390 to 17105 would be the immediate reference for the coming week below which BankNifty could continue to probe lower. On the upside, there would be a good chance of the 80% Rule coming into play in this week’s Value Area if the auction can sustain above 17390.

Main Weekly Hypos for Bank Nifty (Spot):

A) BankNifty needs to sustain above 17295 for a probe to 17360-390 / 17425-480 / 17555-579 / 17625-730 / 17820-890 / 17940-955 & 18025-70

B) The auction gets weaker below 17235 for a test of 17154-095 / 17027* / 16966-901 / 16835 / 16752-723 / 16641-635 & 16575-513

Extended Weekly Hypos

C) Above 18070, BankNifty can probe higher to 18160-225 / 18290-360 / 18430-500 / 18570-630 / 18700-795 / 18840 & 18910-945

D) Below 16513, lower levels of 16449-385 / 16338-257 / 16193-129 / 16078-003 / 15959-876 / 15839*-751 / 15688-625 & 15563-525 could come into play

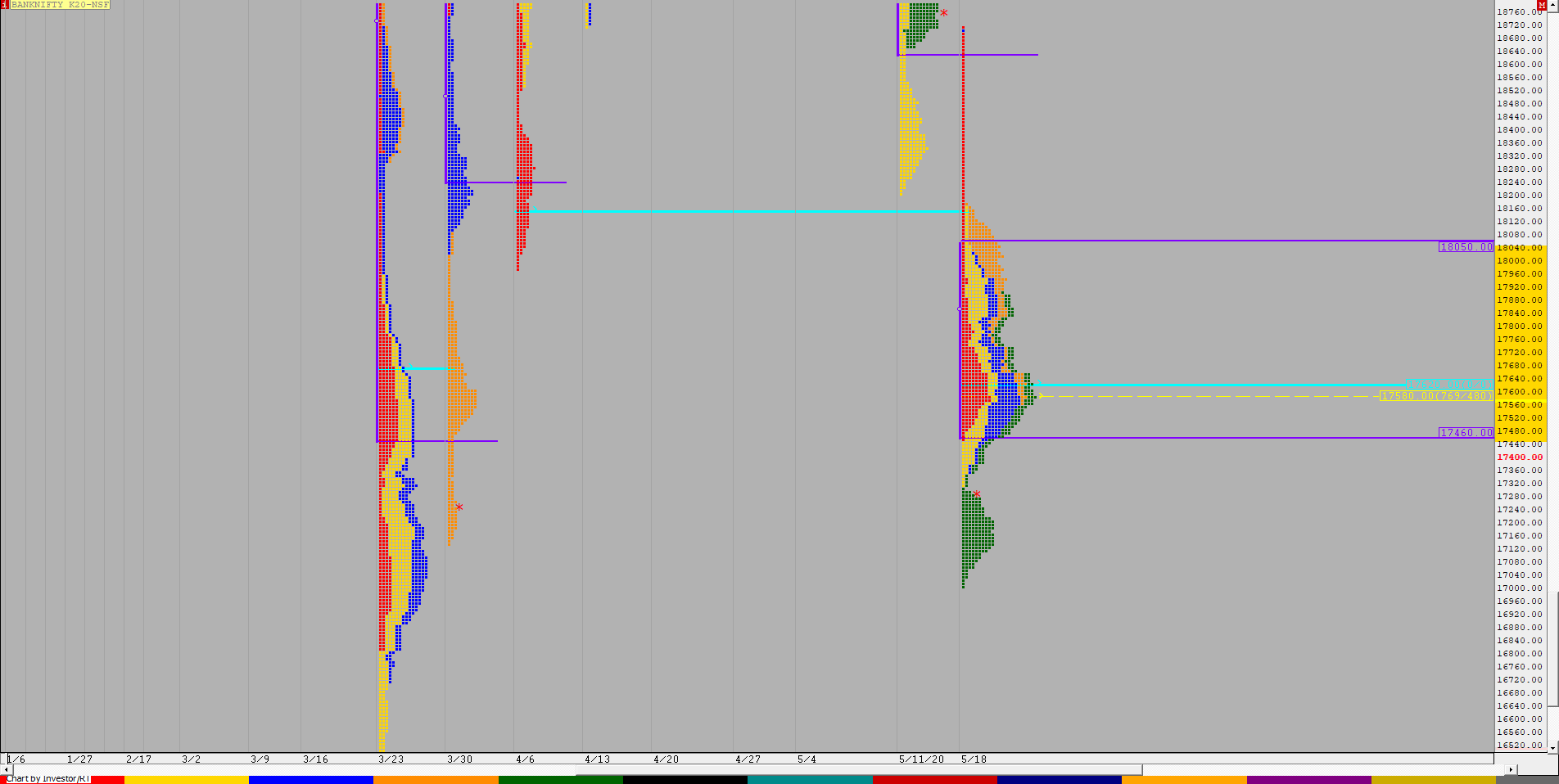

BNF (Weekly Profile)

17216 [ 18711 / 17006 ]

BNF completed the 1 ATR objective of 17589 from the weekly FA of 20199 on Monday leaving a ‘b’ plus spike profile on the weekly with completely lower Value at 17460-17620-18050 along with an extension handle at 17318.