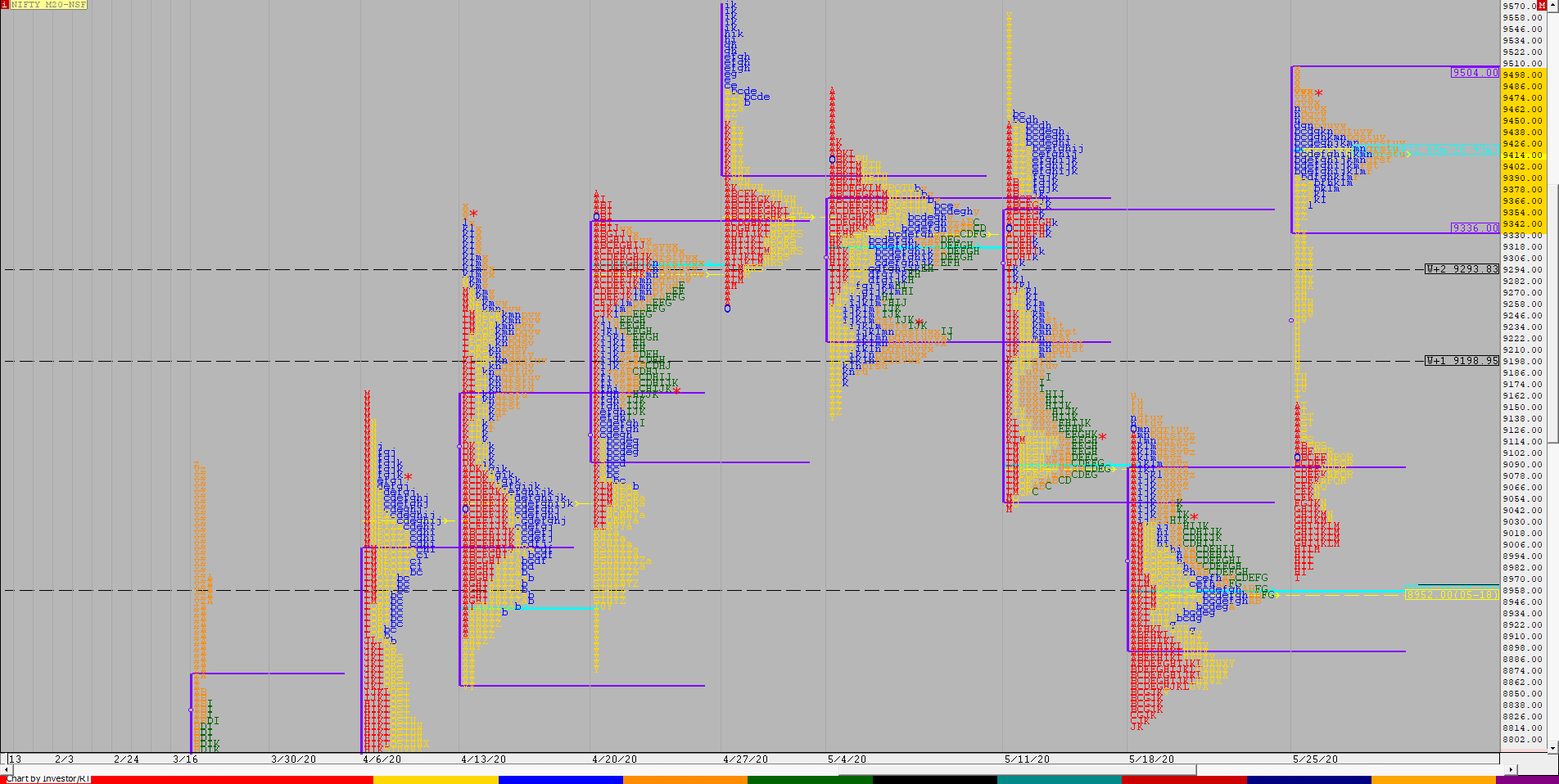

Nifty Spot Weekly Profile (26th to 29th May 2020)

Spot Weekly – 9580 [ 9599 / 8996 ]

Nifty opened higher this week but once again got rejected from the 9160-9180 zone as it made a high of 9161 on Tuesday and probed lower all day getting into the previous week’s Value but ended up stalling at 9004 & 8996 unable to tag the weekly POC of 8955. The auction made a low of 9004 once again on Wednesday in the IB which confirmed that the demand was active in this zone and this led to the first Trend Day Up for the month which also confrimed 2 weekly FAs of 8806 & 8996 and this new imbalance continued till Friday as the auction went on to make new highs for the month at 9599 before closing the week at 9580 leaving a nice 2-day balance.

The weekly profile resembles a Double Distribution (DD) Trend Up one with completely higher & expanding Value at 9126-9462-9597 but will need to find new volumes above 9604 which is the 1 ATR target from the weekly FA of 8806 to continue the probe higher towards the 1 ATR objective from the FA of 8996 which comes to 9783.

Click here to view this week’s auction in Nifty with respect to previous week’s profile on MPLite

Main Weekly Hypos for Nifty (Spot):

A) Nifty needs to stay above 9605 for a rise to 9654 / 9681-9703 / 9752 / 9783-9801 / 9851-9906 & 9950-10001

B) The auction has immediate support at 9555-50 below which it could test 9510-9462 / 9424-09 / 9361-12 / 9265-58 / 9221-13 / 9172-50 & 9121-06*

Extended Weekly Hypos

C) If 10001 is taken out, Nifty can probe higher to 10050-101 / 10150-202 / 10252 / 10294-303 / 10354 & 10396-402

D) Break of 9106 could bring lower levels of 9075 / 9025-18 / 8996-80 / 8955**-27 / 8875-55 / 8805-8790 & 8748*-8696

NF (Weekly Profile)

9494 [ 9509 / 8974 ]

NF has formed a DD too on weekly with completely higher Value at 9336-9420-9504 and has also confirmed a weekly FA at 8974 and looks good for a probe to the 1 ATR target of 9772 in the coming week(s).

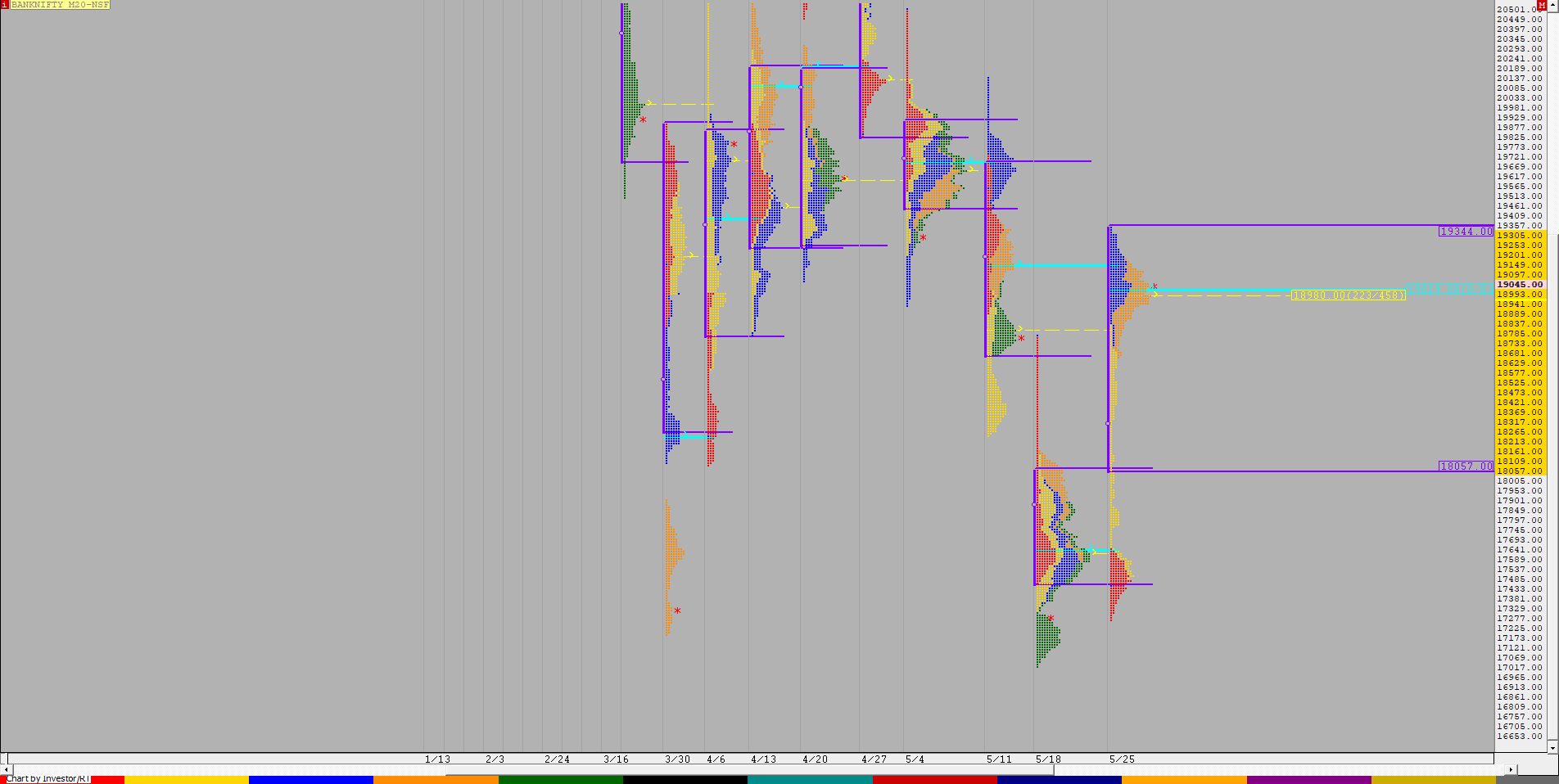

BankNifty Spot Weekly Profile (26th to 29th May 2020)

Spot Weekly – 19297 [ 19455 / 17311 ]

Previous week’s report ended with this ‘the weekly profile also represents a ‘b’ shape with a spike lower indicating long liquidation happening with the Value also being formed completely lower at 17480-17730-18070. The spike zone of 17390 to 17105 would be the immediate reference for the coming week below which BankNifty could continue to probe lower. On the upside, there would be a good chance of the 80% Rule coming into play in this week’s Value Area if the auction can sustain above 17390‘

BankNifty opened higher & just inside previous week’s Value rejecting the spike of 17390 to 17105 but could only make a high of 17681 in the Initial Balance (IB) on Tuesday as it stalled just below the weekly POC of 17700 and started to probe lower making new lows for the day as it got into previous week’s spike zone but got rejected from 17311 to close the day at 17440. The auction opened higher on Wednesday and matched the previous day high as it made a marignal new high of 17683 in the IB and made a big move from the ‘C’ period onwards where it left an extension handle not just on the daily but also on the weekly timeframe at 17683 as it not only completed the 80% Rule in the weekly Value but also went on to tag the previous week’s high of 18795 as it hit 18874 confirming a weekly FA at 17311. This imbalance continued on Thursday as BankNifty tagged the weekly VPOC of 19210 and made new highs of 19304 in the IB and completed a hat-trick of Range Extensions to the upside as it tagged 19455 but was not able to complete the 1.5 IB objective which indicated that the imbalance may be coming to an end resulting in a small retracement in the second half as it closed the day at 19170. Friday saw a lower opening as the auction went below PDL but got rejected from the low volume zone of the Trend Day after making a low of 18730 and got back into previous day’s range to form a nice 2-day Gaussian profile before closing the day & week at 19297.

The weekly profile just like in Nifty is a DD but over a far bigger range of more than 10% with the Value for this week at 18130-19060-19450 which was completely higher than the previous Value. The POC of the 2-day composite at 19157 would be the first reference on the downside in BankNifty for the coming week below which there is this week’s POC of 19060 which will be the next reference. We have a low volume zone from 18730 to 17683 which forms the middle part of the DD & the lower distribution has the HVN at 17570 which would be the important levels in the coming week(s). On the upside, BankNifty would need to sustain above this week’s high to probe towards the selling tail of 19830 to 20122 which would also complete the 1 ATR objective of 19903 from this week’s FA and acceptance above 20122 could start a fresh leg on the upside.

Main Weekly Hypos for Bank Nifty (Spot):

A) BankNifty needs to sustain above 19321 for a probe to 19397-461 / 19531-600 / 19650*-710 / 19741-793 / 19830-903 / 19952-20022 & 20123-238

B) The auction has immediate support at 19297-250 below which it could test 19180-104 / 19060-18975 / 18855-770 / 18700-599 / 18500-399 & 182953

Extended Weekly Hypos

C) Above 20238, BankNifty can probe higher to 20310-380 / 20450-530 / 20595-665 / 20730-809 / 20880-950 / 21025-102 & 21171-245

D) Below 18295, lower levels of 18225-130 / 18090-17958 / 17880-846* / 17785-683 / 17625-555 / 17500-425 & 17354-311 could come into play

BNF (Weekly Profile)

19099 [ 19350 / 17267 ]

BNF also formed higher Value this week at 18057-18980-19344 along with a FA at 17267 as it made a DD profile with the 1 ATR target coming to 19949.