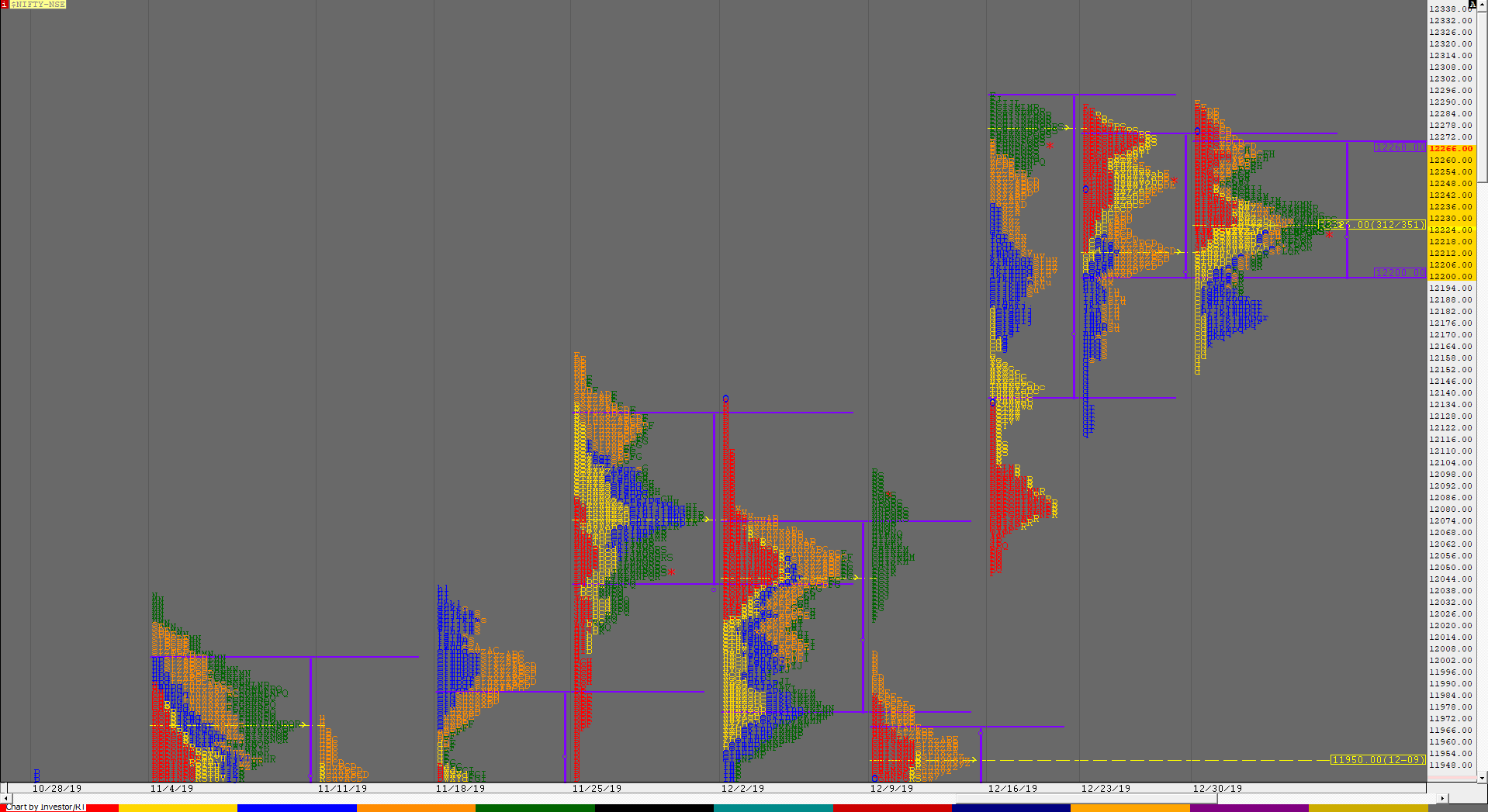

Nifty Spot Weekly Profile (30th December 2019 to 3rd January 2020)

Spot Weekly 12226 [ 12290 / 12152 ]

Previous week’s report ended with this ‘the auction will need to get above that vPOC of 12265 & negate the FA of 12287 in the coming week whereas the immediate support is in the zone of 12230-12210‘

Nifty opened this week with a gap up above the vPOC of 12265 but could not take out the FA and previous week’s high of 12287 as it made a high of 12286 on Monday and reversed the probe to the downside giving a trending move over the next 2 days as the auction completed the 80% Rule in previous week’s Value of 12272 to 12200 and went on to break below Friday’s low of 12157 as it made lows of 12152 but once again looked like being supported there. Wednesday re-confirmed the support at 12157 as Nifty made an inside bar after which it gave a drive up open on Thursday which retraced the entire move lower from Monday’s high to leave a Trend Day Up and closing in a spike from 12273 to 12290 marginally scaling above the 12287 level. However, Nifty opened lower on Friday rejecting the spike which was the first signal that the 12290 zone was still resisting after which it made a C side range extension at 12266 but got rejected and went on to make new lows for the day as it not only confirmed a daily FA at 12266 but also confirmed a weekly FA at 12290 as it made lows of 12191 before closing the week at the weekly POC of 12226. Range wise Nifty stayed in one of the narrowest weekly range of just 138 points which was last seen in Jan 2019 and was almost an inside bar with the weekly Value also overlapping the previous 2 week’s Value which sets up for a good move in the coming week(s). The weekly Value is at 12200-12226-12268 & the 3 week composite has Value at 12189-12265-12283.

Weekly Hypos for Nifty (Spot):

A) Nifty needs to sustain above 12228 for a move to 12266 / 12290 & 12321

B) Immediate support is at 12210 below which the auction could test 12185*-182 / 12156-152 & 12129*

C) Above 12321, Nifty can probe higher to 12347-377 / 12405 & 12433-441

D) Below 12129, lower levels of 12103-077 / 12051-46 & 12004-11991 could come into play

E) If 12441 is taken out, Nifty can have a fresh leg up to 12470-489 & 12540-545

F) Break of 11991 could bring lower levels of 11976-962* / 11936 & 11910-881

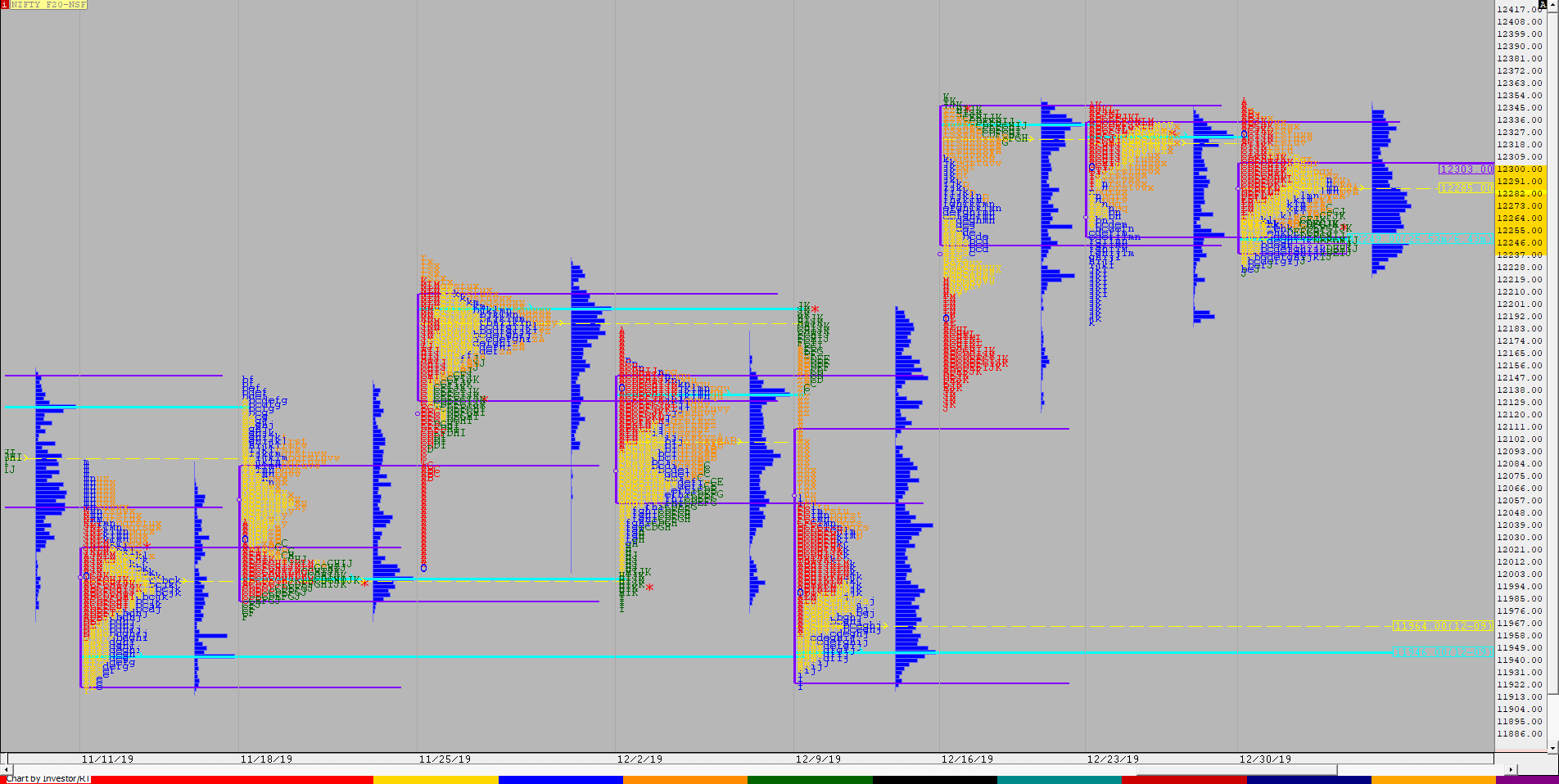

NF (Weekly Profile)

12256 [12348 / 12223]

NF stayed in a very narrow range of just 125 points this week making a balanced profile with overlapping Value at 12237-12285-12303. We have a 3-week composite forming and there is a good chance of the auction moving away from this composite in the coming week. The composite Value is at 12234-12252-12315.

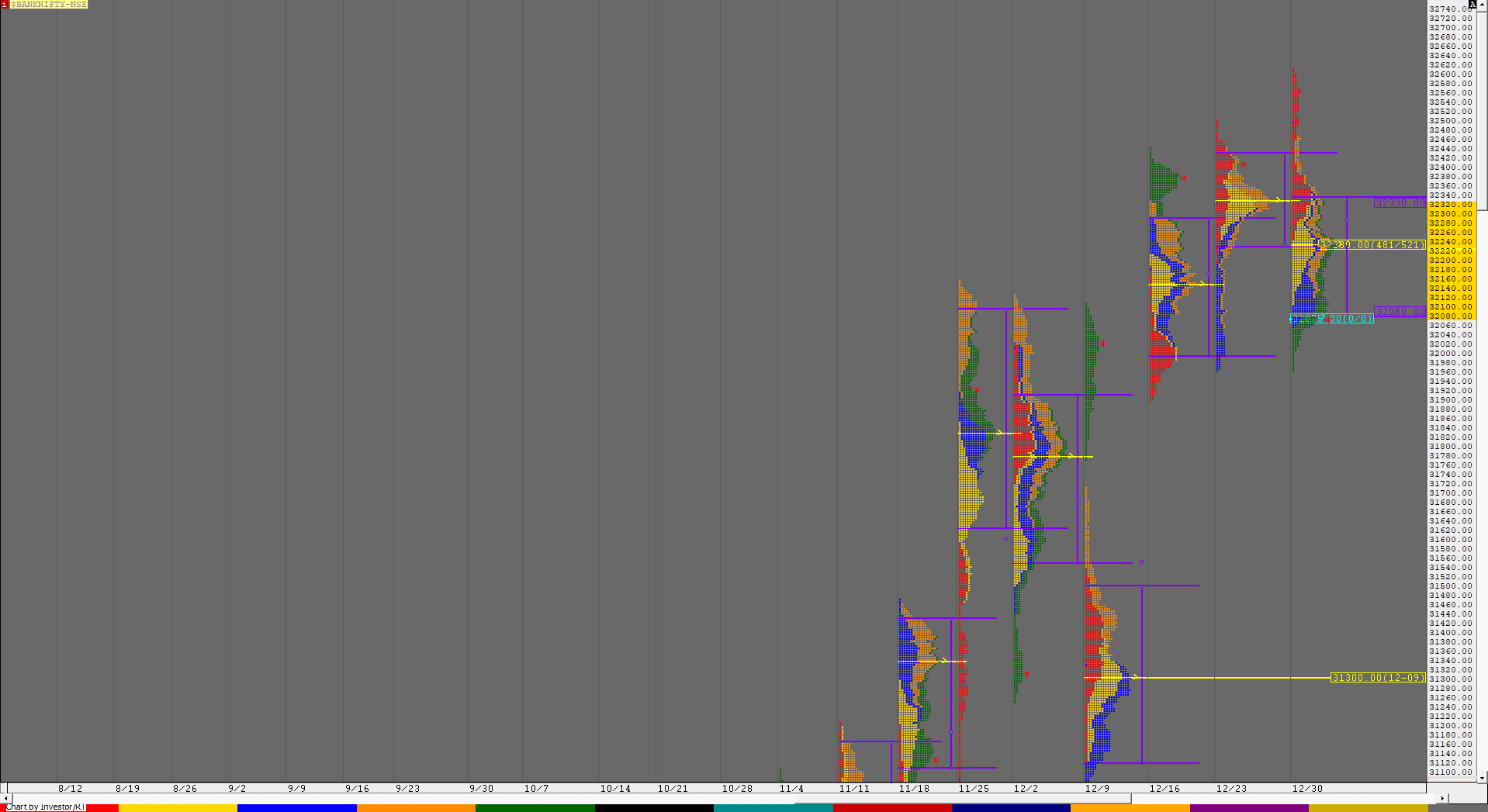

BankNifty Spot Weekly Profile (30th December 2019 to 3rd January 2020)

32069 [ 32613 / 31960 ]

BankNifty opened the week on a strong note as it gave a gap up above previous week’s high & then went on to negate the FA of 32503 making new all time highs of 32602 in the Initial Balance on Monday. The auction then made a ‘C’ side range extension (RE) which failed and this set up a trending move to the downside for the day as it not only confirmed a new FA at highs but also went on to complete the 1 ATR objective of 32290 on the same day after leaving an extension handle at 32464 as it made lows of 32248. BankNifty continued to probe lower on the next 2 days after getting rejected from previous week’s prominent POC of 32325 at open as it made lower lows of 32108 & 32057. Thursday saw a gap up opening above the POC of previous day’s ‘b’ shape profile which meant that the auction to the downside was getting a bit stretched and this led to a good short covering move as BankNifty made a trending move higher all day to get back above the 32325 level & closed in a spike of 32365 to 32465 stalling right at the extension handle of Monday which was a good clue. The next day open was a gap down as BankNifty not only rejected the spike close of Thursday but once again got rejected at that 32325 level giving an Open Test Drive to the downside inspite of the lower opening and went on to make multiple REs making new lows for the week at 32036 in the ‘G’ period after which it have a pull back high at 32121 before it went on to break below previous week’s low of 31963 and in the process completed the 2 ATR objective of 31968 from the FA of 32613 making lows of 31960. There was a small bounce into the close as the auction left a tiny buying tail from 32007 to 31960 as it closed the week at 32069 leaving an outside bar with an excess in the form of an FA at all time highs with overlapping to lower Value at 32080-32280-32330 but the PLR (Path of Least Resistance) seems to be down as the close has been below the VAL for the first time in 4 weeks with 32100 being the immediate reference on the upside as the 3 week composite Value in BankNifty stands at 32098-32366-32393

Click here to view the BankNifty action this week with respect to the 3-week composite on MPLite

Weekly Hypos for Bank Nifty (Spot):

A) BankNifty needs to sustain above 32100 for a move to 32165 / 32221-280 & 32330-350

B) Immediate support is at 32041 below which the auction could test 31960-952 / 31874-858 & 31810-774

C) Above 32350, BankNifty can probe higher to 32393-401 / 32465-490 & 32581-613

D) Below 31774, lower levels of 31685 / 31620-595 & 31505-495 could come into play

E) If 32613 is taken out, BankNifty could rise to 32670 / 32750-760 & 32810

F) Break of 31495 could trigger a move lower to 31424*-418 & 31330-300*

G) Sustaining above 32810, the auction can tag higher levels of 32855-865 / 32943 & 33000-034

H) Staying below 31300, BankNifty can probe down to 31240 / 31155-120 & 31065

BNF (Weekly Profile)

32161 [ 32774 / 32060 ]

BNF started the week higher as it went on to make new all time highs at 32774 but once again just like the previous week confirmed a daily FA on Monday which set up for a trending weekly profile to the downside as the auction completed the 2 ATR objective of 32142 on Friday making an outside bar on the weekly with overlapping to lower Value at 32256-32400-32528. Like NF, BNF has also formed a 3-week composite but has closed well below the composite Value of 32271-32400-32550 which means the PLR for the coming week would be to the downside.