Are you looking to improve your trading performance with Volume Profile?

In this article, we will cover all the essential queries about Volume Profile and provide you with practical tips for using it in your trading strategy.

Let’s dive in.

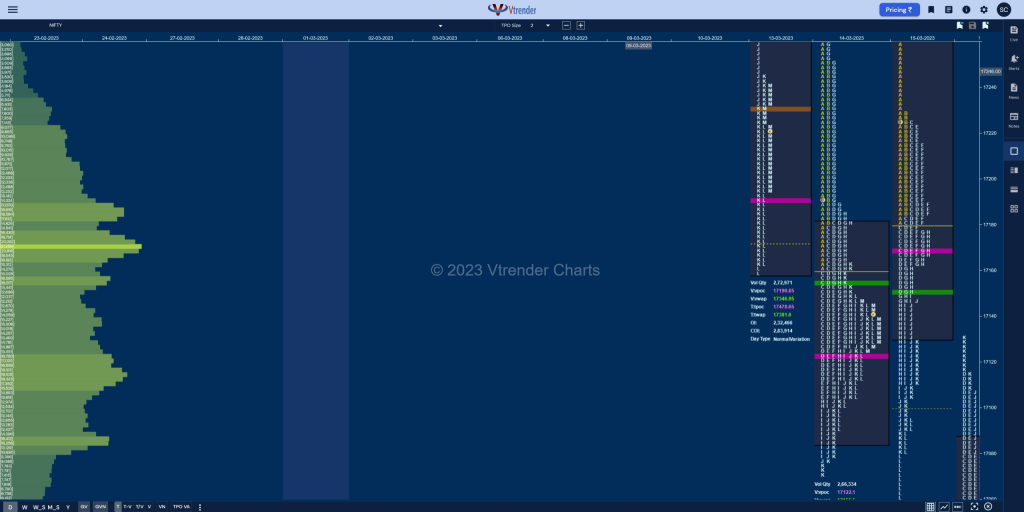

The charts above which has the Volume histogram in fluorescent green to the left is a typical Volume Profile Chart.

We plot it with a TPO based MarketProfile chart, but you can plot it on any bar, candlestick or any chart which generates Volume data

As a trader who trades off Volume Profile everyday and for the past 15 years , I want to share my knowledge on using Volume Profile correctly, highlighting the significance of HVNs and LVNs and how price moves around them.

What is Volume Profile in technical analysis?

Volume Profile is a charting technique used in technical analysis that displays the volume of trades at specific price levels, as opposed to traditional volume bars that show the volume over a specific time period.

We plot Volume on the Y axis instead of how it is traditionally done on the X axis or below price bars

This data is then presented in the form of a histogram, revealing areas of high volume (HVN) and low volume (LVN) activity.

It presents a unique perspective on the market by analyzing the distribution of trading volume over specific price levels.

Understanding HVNs and LVNs can help traders identify key support and resistance levels based on the actual trading activity.

How to use Volume Profile in your trading strategy?

Volume Profile offers various trading strategies that can be tailored to suit different trading styles and goals.

Some of the most effective strategies include using HVNs and LVNs as reference points for placing stop-loss orders or target levels, paying attention to price and volume interaction, and using composite profiles to identify significant HVNs and LVNs that persist over a more extended period.

By incorporating these strategies into your trading plan, you can make more informed decisions and achieve your financial objectives.

How to trade with Volume Profile?

If you want to use Volume Profile in your trading strategy, here are some tips for getting started:

Identify key HVNs and LVNs, use HVNs and LVNs as reference points, and pay attention to price and volume interaction.

High Volume Nodes (HVNs)

High Volume Nodes (HVNs) are price levels at which a significant amount of trading activity has taken place. These areas represent substantial interest from market participants and usually act as strong support or resistance levels.

When the price approaches an HVN, there are a few possible scenarios:

Reversal: The price may reverse its direction, as the HVN acts as a support or resistance level. In this case, traders can use the HVN as an entry point for placing buy or sell orders, anticipating a bounce off the level.

Consolidation: The price may consolidate around the HVN, indicating that the market is in a state of equilibrium. During consolidation, traders can use the HVN as a reference point to place stop-loss orders or target levels for potential trades.

Breakout: The price may break through the HVN, showing a strong momentum move. In this case, traders can use the HVN as a trigger for entry or exit signals, depending on the direction of the breakout.

Low Volume Nodes (LVNs)

Low Volume Nodes (LVNs) are areas on the Volume Profile where trading activity is relatively low compared to other price levels. LVNs can provide valuable information about potential turning points in the market or areas where price might quickly move through.

When the price encounters an LVN, there are a couple of possible outcomes:

Reversal: Occasionally, price may reverse at an LVN, especially if it aligns with other technical factors, In this case, traders can use the LVN as a potential entry or exit point, anticipating a reversal.

- Fast Price Movement: Since there is limited trading activity at the LVN, price tends to move quickly through these levels. Traders can use LVNs as potential targets for taking profits or to anticipate rapid price changes.

More concepts within Volume Profile

There are more concepts within Volume Profile that can be applied to a broader range of prices and timeframes, extending beyond intraday analysis.

Some of these concepts include:

Long-term POC and Value Area: Analyzing the Point of Control (POC) and Value Area over more extended periods, such as weeks, months, or even years, can help traders identify significant long-term support and resistance levels. These levels can be beneficial for position traders and investors looking to make strategic decisions.

Cumulative Volume Profile: This technique involves accumulating volume data over a specified period to create a composite profile. By doing so, traders can identify key levels of interest that persist over time, offering valuable insights into longer-term market dynamics.

Volume Divergence: By comparing volume distribution patterns over different timeframes, traders can identify instances of volume divergence. This occurs when there is a discrepancy between price movement and volume distribution, which can signal potential trend reversals or continuations.

Market Development Phases: Traders can use Volume Profile to identify different market development phases, such as accumulation, distribution & markup

Practical Tips for Using Volume Profile

To effectively use Volume Profile in your trading strategy, consider the following practical tips:

Choose the right timeframe: Depending on your trading style, select an appropriate timeframe for your analysis. Day traders may focus on intraday timeframes, while swing traders and position traders may opt for daily or weekly charts. Remember, the Volume Profile will vary based on the chosen timeframe, so ensure it aligns with your trading goals.

Monitor multiple timeframes: Analyze the Volume Profile on different timeframes to gain a broader perspective on the market. This can help you identify key support and resistance levels that are relevant across various time horizons.

Use composite/cumulative profiles: Combine Volume Profiles from multiple sessions or timeframes to create a composite profile. This can help you identify significant HVNs and LVNs that persist over a more extended period, which may be more reliable than short-term levels.

Be flexible with HVNs and LVNs: Remember that HVNs and LVNs are not fixed price levels, but rather zones where significant trading activity has occurred. Be prepared to adjust your entries, exits, and stop-loss orders based on how the market reacts to these areas.

Observe price and volume interaction: Pay attention to how price reacts when approaching HVNs or LVNs. This can provide valuable information about the strength of support or resistance, and help you anticipate potential reversals or breakouts.

Practice and refine your approach: As with any trading tool, practice is essential. Invest time in studying past market data and observing the Volume Profile in real-time.

Unleashing the Power of Volume Profile

In summary, incorporating Volume Profile into your trading strategy and following the practical tips and strategies mentioned above can help you gain valuable insights into the market’s behavior and identify crucial support and resistance levels through HVNs and LVNs.

By consistently practicing and persisting with Volume Profile, you can enhance your decision-making process and improve your overall trading performance. Whether you’re a day trader, swing trader, or position trader, understanding and effectively using Volume Profile can help you achieve your financial objectives.

So why wait? Start mastering Volume Profile trading today!