A 3 Dimensional Approach adds an extra edge !

- To build the auction, one has to understand clearly that

- Price — advertises opportunity. (and not all price is value)

- Time — regulates this opportunity

- Volumes — Measure whether the opportunity was a success or failed.

What is the Market Profile?

The Market Profile is a 3-dimensional approach to trading the markets. Historically only price has been used to graph market activity and we see this in the traditional bar and candlestick charts which are common amongst traders.

The Market Profile approach is to plot Price, Volume and Time together on one chart. Price is measured on the vertical or Y axis and Time is measured on the horizontal axis. The interaction of Price and Time creates Volume which is measured on the chart directly.

The Market Profile approach is to view the movement of the market as an auction which has both Buyers and Sellers trying to out do each other or arrive at a fair price which is called the value of the market.

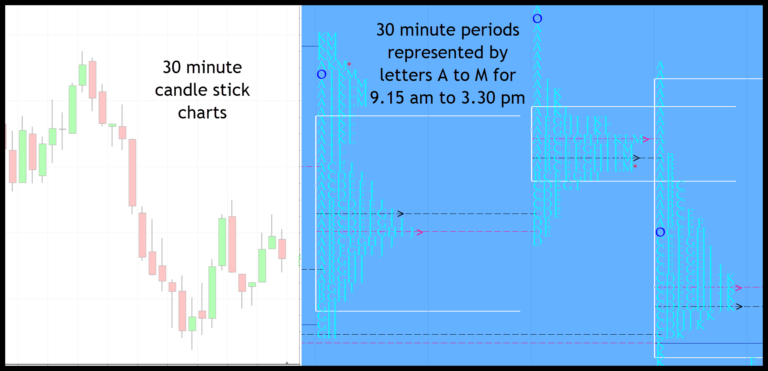

Price chart versus a MarketProfile Chart

In the chart above we see a 30-minute bar of an instrument which tells us about the movement of the underlying in the color of the bar and a few patterns of the bar called candlestick patterns which are dependent only on the relation between the Open and the close of the bar.

In candlestick charts, the entire focus goes on the close of the bar which determines even the color of the bar.

In the Market Profile chart on the right, we see a lot more information and is a truer representation of the process of the buying and selling which has occurred in the market. We go much beyond the Open, High, Low and Close of the bar and the Market Profile gives us more information in terms of where the market has seen the most number of transactions and which part of the day was dominated by the Buyer or the Seller the most.

Advantages of using the MarketProfile approach

The Market Profile approach to trading is a truer approach giving a clearer X-ray view to the trader of the Buying and Selling actually happening.

It also allows us to know which Time frames are active and we get an insight into their inventory positions, participation, emotional trading etc, not available in traditional charting patterns.

This detailed examination through a Market Profile chart can allow traders to cut losses, decrease risk and increase the chances of profitability in their trading.

The Market Profile charts are available for a free view in the charts section of our website here. You can see the charts Live in the working hours of the exchange. Go to charts.vtrender.com for the same

Market Profile Versus Volume Profile: A Comparison

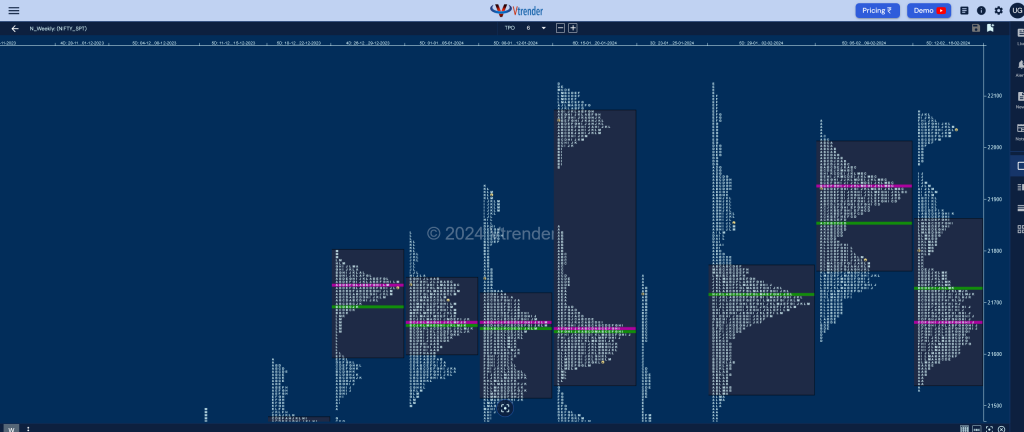

An advanced form of the Market Profile is the Volume Profile .

The Market Profile was developed in the late 60’s when the exchanges did not give Volume Information to the market participants. As a way around, the early profilers came up with a formula which is Price X Time = Volume.

Even today this formula is remarkably close to getting the Volume of the market.

However as the exchanges now give us Volume, we can add Volume directly to a Market Profile graph. This is called the Volume Profile of today.

The Volume Profile plots the traded volume on the Price Histogram of the chart and shows us areas where the market has generated high Volume or low volume. This works better than plotting Volume below a price bar, which does not hint to where the major traders exchanged volume during a price move.

Orderflow : An advanced form of Volume Profile analysis

An advanced form of the Volume Profile is called the Orderflow.

The Orderflow goes inside the Volume at each price and shows us where and when the Buyer or a seller were aggressive during a price move.

A series of such aggressive moves when plotted in a chart can point to a market turning or exhausting or starting a new wave.

You can read more about the Order Flow at – https://www.vtrender.com/what-is-order-flow/

Popular Trading Setups with MarketProfile analysis

Market Profile analysis can provide valuable insights into popular trading setups used by traders.

For example, the 80% rule, failed auction, and poor highs/lows are popular trading setups that traders can use to enter trades. By using Market Profile charts to identify these setups and aligning trades with dominant buyers or sellers, traders can increase their chances of profitability in the market.

Here are a few examples of popular trading setups that traders might use with the Market Profile:

80% Rule

This is a popular trading setup based on the observation that the market tends to revisit the high or low of the previous day’s range 80% of the time. Traders may use this setup to enter trades at these levels, with a stop loss placed above or below the range.

The 80% Rule is a simple yet effective way to identify potential trading opportunities with a high probability of success. By using the Market Profile, traders can get a better understanding of the market’s behavior and apply this rule to improve their trading results.

Failed Auction

A failed auction occurs when the market tests a level and is unable to find enough buyers or sellers to continue in that direction. Traders may use this setup to enter trades in the opposite direction of the failed auction.

Traders may also use this setup to identify potential areas of support or resistance, as failed auctions often indicate a level where market participants have changed their view on price direction. It can be a powerful tool for swing trading and position trading.

A more comprehensive writeup of the FA is at – https://vtrender.com/of-failed-auctions-and-revisits/

Poor Highs/Lows

When the market forms a poor high or low, meaning there is an unsecured high/low at that level, traders may look for opportunities to enter trades for a revisit of the poor high or low.

This is because these levels tend to offer favorable risk-reward ratios for traders. The Market Profile can help identify these poor highs or lows with greater accuracy.

Rotational Trading

This setup involves looking for opportunities to trade within the value area of the Market Profile chart. Traders may enter trades when the market rotates back towards the point of control, with a stop loss placed below the value area.

Additionally, rotational trading can help traders identify the balance and imbalance areas of the market and make informed trading decisions based on market dynamics.

You can also find more about the terms at – https://vtrender.com/market-profile-terminology/

Market Profile Analysis: A Truer Approach to Trading the Markets

These are just a few examples of trading setups that traders may use with the Market Profile. There are many other strategies and techniques that traders can use, depending on their individual trading styles and preferences.

Interpretation and Analysis of the chart in a Live Market Situation can be done by simple market profile based strategies as shown above and aligning your trade with a dominant Buyer or Seller as shown in the charts.

We use MarketProfile, Volume Profile and Orderflow for a trading edge in the Vtrender Mentoring Room.

A preview of the Vtrender Mentoring Room and it’s benefits is at — https://vtrender.com/mentorship/

A bit more on the Market Profile with the Terminology

The market profile recognizes five distinct types of individuals who operate in the markets. These are a) Scalper, b) Day trader, c) Short-term player, d) Intermediate-term player, e) Long-term player. Each of these individuals have a perception which they bring to the market and this perception helps move the markets. The scalper and the day trader are responsible for maintaining the liquidity of the markets.

The perception which all of the above-mentioned players bring to the markets after the bid-ask process helps build what we call “value”. Value is different for each of the mentioned players and they will move the price up or down depending on this perception. For example, if the intermediate term seller thinks that the market is overpriced he will jump in to move price down. On a daily timeframe, the period where 70 % of the volume action takes place is defined as the value area. Similarly, we have a weekly and a monthly value area.

Individuals of any timeframe who feel that the present market is underpriced and therefore less in value. These individuals will move price up.

Same role as the above except they think that the market is overpriced and will move the price down.

The activities of buyers and sellers recorded through the bid-ask process is called auction. The auction results in the formation of the value area which the buyers and the sellers agree as the fairest value for the day. As the auction moves away from the value area, buyers and sellers change their definition of value. If higher prices are agreed upon in the auction, the value is supposed to move higher and consequently, the market moves up.

The failure of the auction at higher levels to attract new buyers results in the sellers swiftly moving in forming what is called a selling tail.

The same activity as above, but in the opposite direction. The bigger the size of the tails the more aggressive is the action/ reaction.

This is the region where the most activity occurs during the day and has a high volume around it as a result. This POC is also considered the fairest price of the day or the week. The POC is measured across daily, weekly, monthly and even yearly time frames.

The POC of the current day developing

This is an area which puts an end to an existing auction through exhaustion rather than an excess. It is also called an unfinished auction and price returns back to this point for a fresh probe after a small pullback.

This is a very important concept in a trending day especially where the market recovered from an initial probe midday to check on old inventory. Participants use the pullback to adjust positions for the trend of the day. The Pullback high/ low is important for the rest of the sessions also as it is associated with inventory.

The proper statistical distribution where the POC is placed in the middle of the profile chart and 68.7% of the day’s trading Volume is on either side of this POC. On the charts, it looks like a Bell kept sideways and hence called a bell curve.

A buying tail or a selling tail is also called an excess. The excess is the end of one auction and the beginning of the other.

An anomaly is an assysmetric structure within the Market profile caused by an unfair auction.

anomalies are revisited often and hence important to identify in the charts.

A move in the markets not fully factored in or priced in by the markets.

when an exogenous event occurs, the markets put in a new reaction to agree or disagree with the event.

Covered in detail here at — https:/ /vtrender.com/market-profile-day-types/

This is the weighted average price of the movement of the instrument. It is calculated by using the ratio of price multiplied by the number of shares divided by total shares traded

The final auction of the day Open The first auction of the day. If there is a large difference in the open and the close then again the perception of value in the market has changed. More types of open are at — http://vtrender.blogspot.com/2011/02/market-profile-glossary.html

A region where trade is contained and the price does not move vertically. This area is also called Value. A balance occurs in all timeframes. A balance is also the end of an auction. Excess and balance are considered opposite terms in an auction.

The opposite of a balance. Price breaks away from a balance to form an imbalance. Either the Buyer or the seller is more aggressive when an imbalance happens

The first 60 Minutes of a trading day is called the initial balance. As the name suggests, the IB tries to set up the day’s balance or define the value for the day.

The movement away from the initial balance is called the range extension. Success or failure of the range extension gives us an indication of the type of day unfolding.

The movement in the last hour of the day is called a spike. A spike is an auction which is not complete and hence unverified. This happens mostly due to exchange closing hours. The next day needs to be watched for confirmation/ rejection of the spike. More — https://vtrender.com/spike-rules/

Control by the buyer or seller in the trading day is called initiative activity. As the name suggests, the action determines conviction on the part of the players to move the market. The strength of the initiative activity is useful to determine which party will have a role to play in the day

This is a response to Initiative activity, the strength of which can determine changes to the trend of the timeframe.

A trending situation or an imbalance driven by Initiative activity

Open Types – what are the different kinds of Open? . read here at – https://vtrender.com/what-are-the-different-open-types-in-market-profile/

A 2 sided trade happening in a chart between buyers and sellers which tells us that the market is very well valued at the current point.

A move away from the initial balance in the Intra day time frame

A move away from previous accepted value in a longer time frame chart

Time Price Opportunities

These are the basic building blocks of the MarketProfile and denote every 30 minutes of trade in a day.

The many benefits of using the Role of Time, Price, and Volume in Market Profile Analysis

Adding Market Profile analysis to your trading arsenal can provide valuable insights into market activity and help you make more informed trading decisions. By plotting price, volume, and time together on one chart, the Market Profile approach provides a truer representation of the buying and selling actually happening in the market.

If you’re interested in learning more about Market Profile analysis and how to generate actionable trading strategies, consider joining the Vtrender Mentoring Room. Our large community of Market Profile traders comes together to watch the charts, discuss trading strategies, and learn from each other’s experiences.

Link up at – https://vtrender.com/mentorship/

Additionally, we offer a Level 2 model of advanced Market Profile strategies that can help you take your trading to the next level. Visit https://www.vtrender.com/ecourse/ to learn more and get started.

Finally, be sure to check out our blog for more Market Profile insights and trading strategies at https://vtrender.com/random-musings-on-market-profile/.

And stay up to date on the latest developments in Market Profile analysis at – https://www.vtrender.com/market-profile-the-evolution/